Why Competitor Analysis Matters

As more businesses launch and expand each year, competition is perpetually increasing.

Simply having a good product or service doesn’t cut it anymore. You need a rock-solid differentiation strategy.

And that’s where competitor analysis comes in.

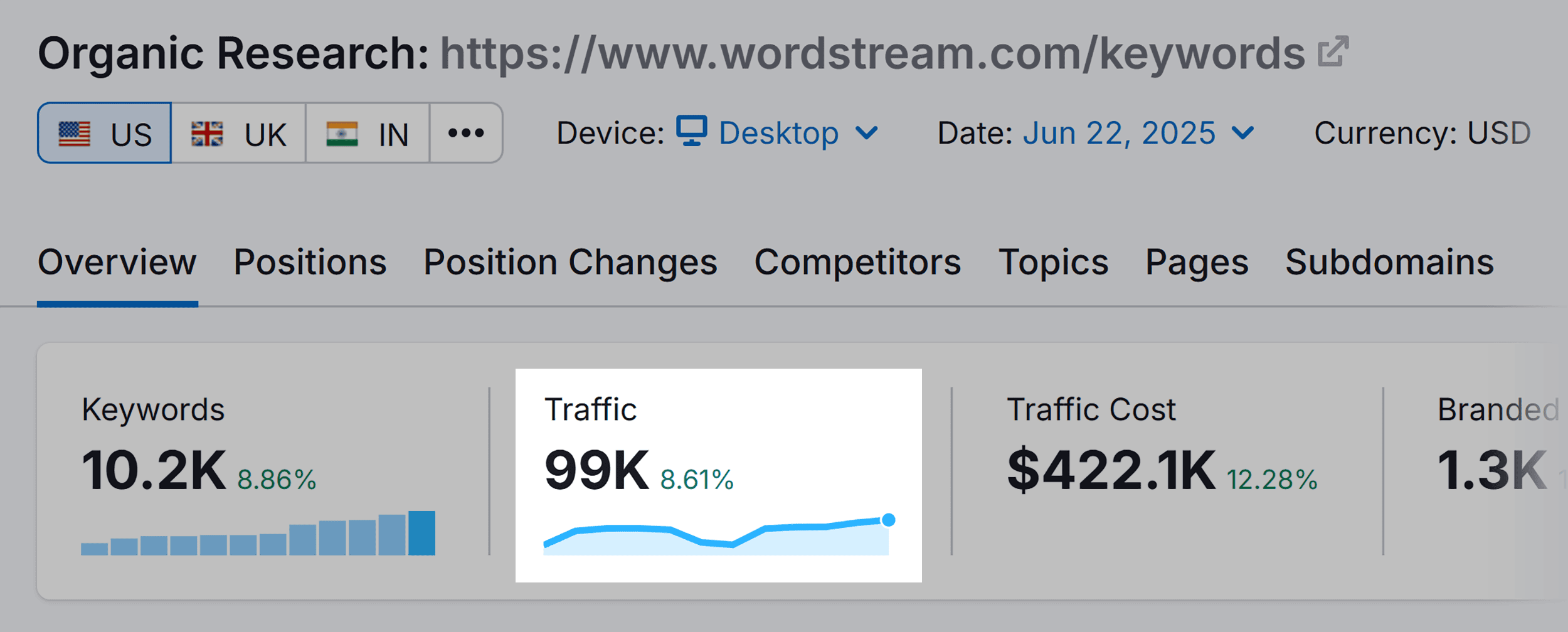

Take our own example. For years, WordStream has owned the #1 spot for “keyword research” — driving an estimated 99,000 monthly visits.

Through competitor analysis, I discovered that WordStream combined a free tool with educational content.

We took that winning formula and improved on it: better functionality, clearer guides, and smoother user experience.

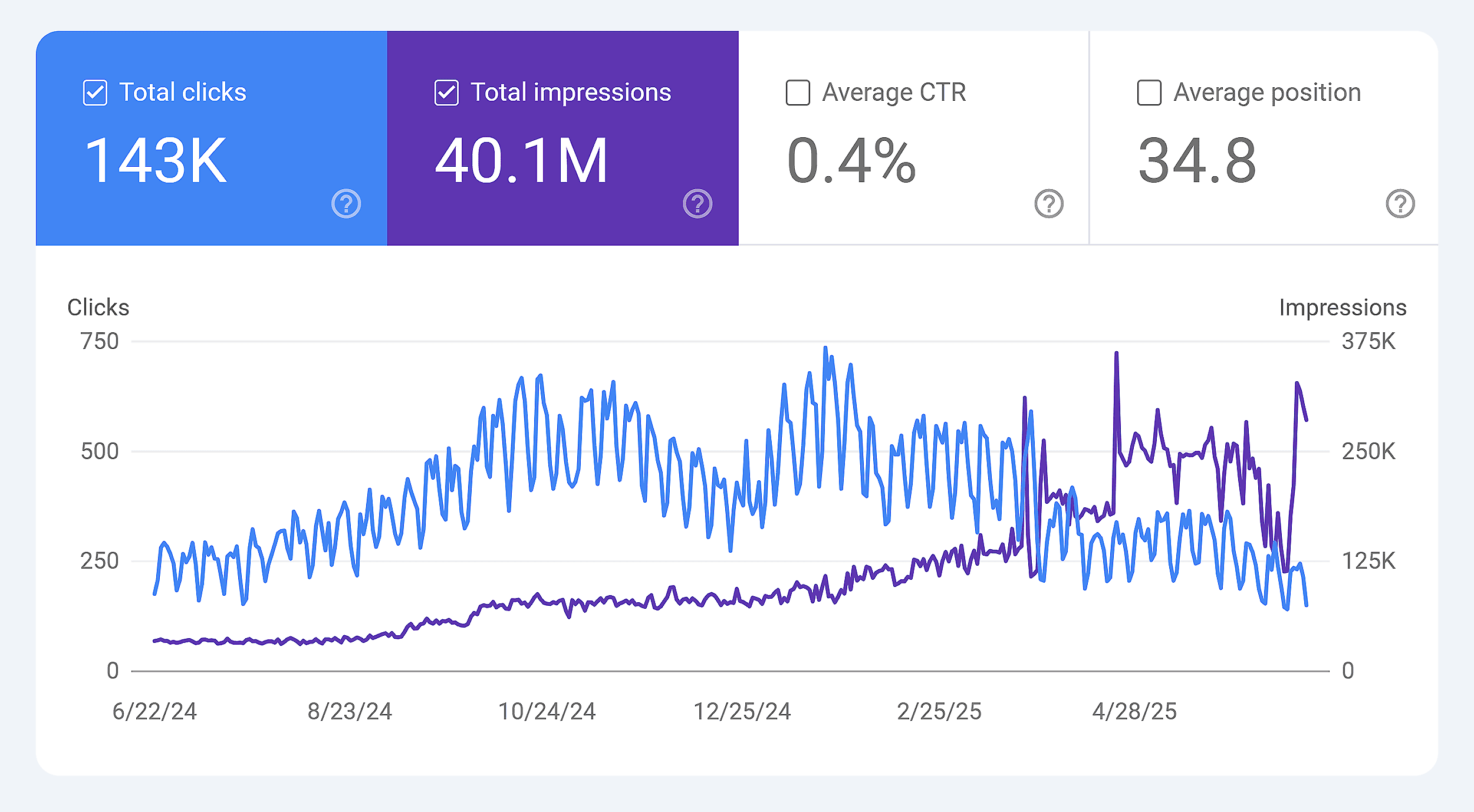

The result? Our page now gets 143K clicks in 12 months — a 626% increase.

That’s the power of competitor analysis.

If you want similar results, you’re in the right place. In this guide, we’ll explore:

- What competitor analysis is

- Who benefits from this process

- How to use it for your business

Use Our Free Competitor Analysis Tool to Kickstart the Process

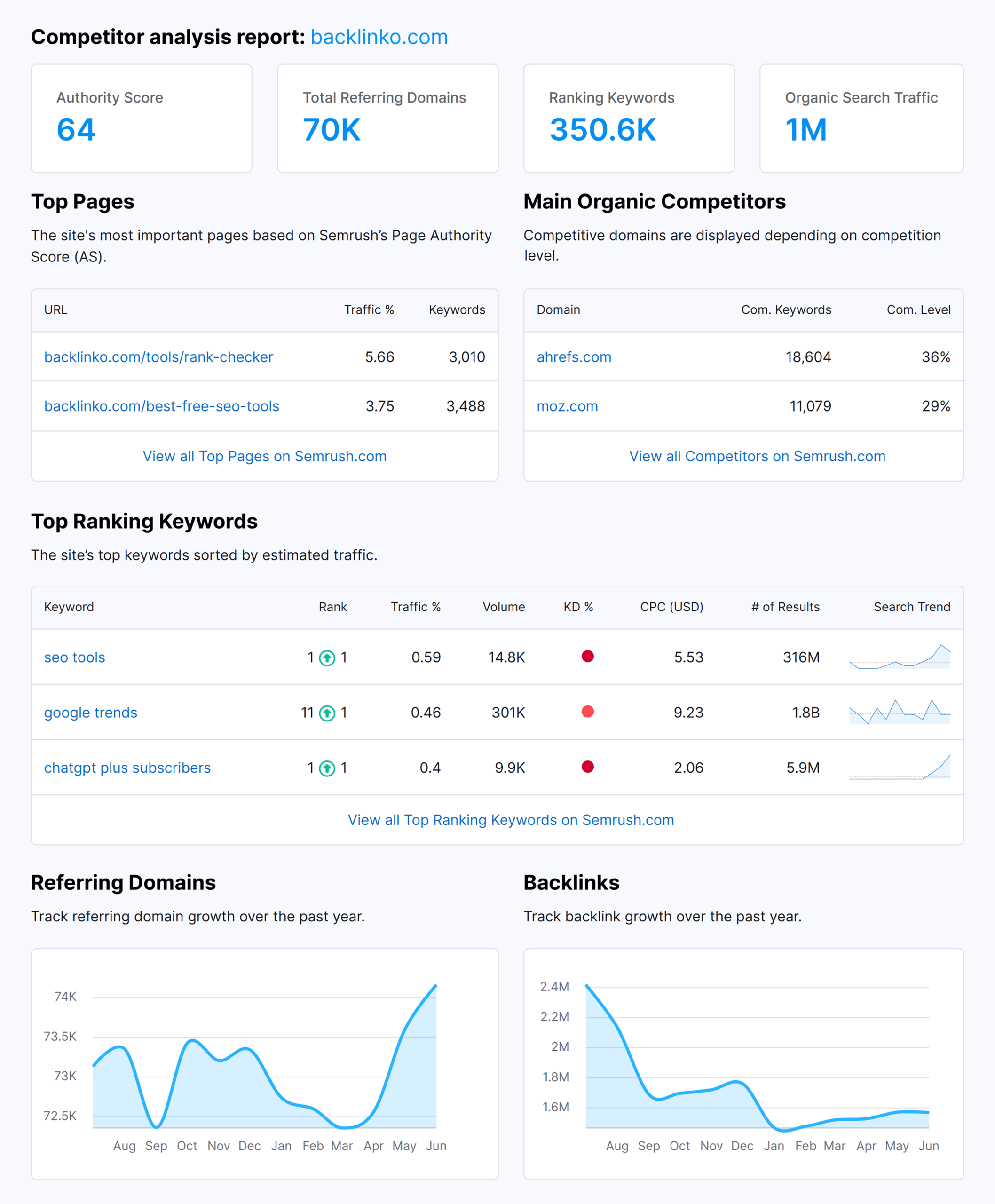

Using our competitive analysis tool is a great way to kick off your research.

Just enter a domain to see SEO metrics like traffic, backlinks, keywords, and top competitors.

Keep that report open. You’ll reference it throughout the process.

What Is a Competitor Analysis?

A competitor analysis is the process of studying your rivals to see what they’re doing well — and where they’re falling short.

It helps you uncover gaps, spot threats, and build strategies that give you an edge.

You’ll look at things like:

- Products and services

- Pricing

- Marketing and advertising

- Customer sentiment

- Brand positioning

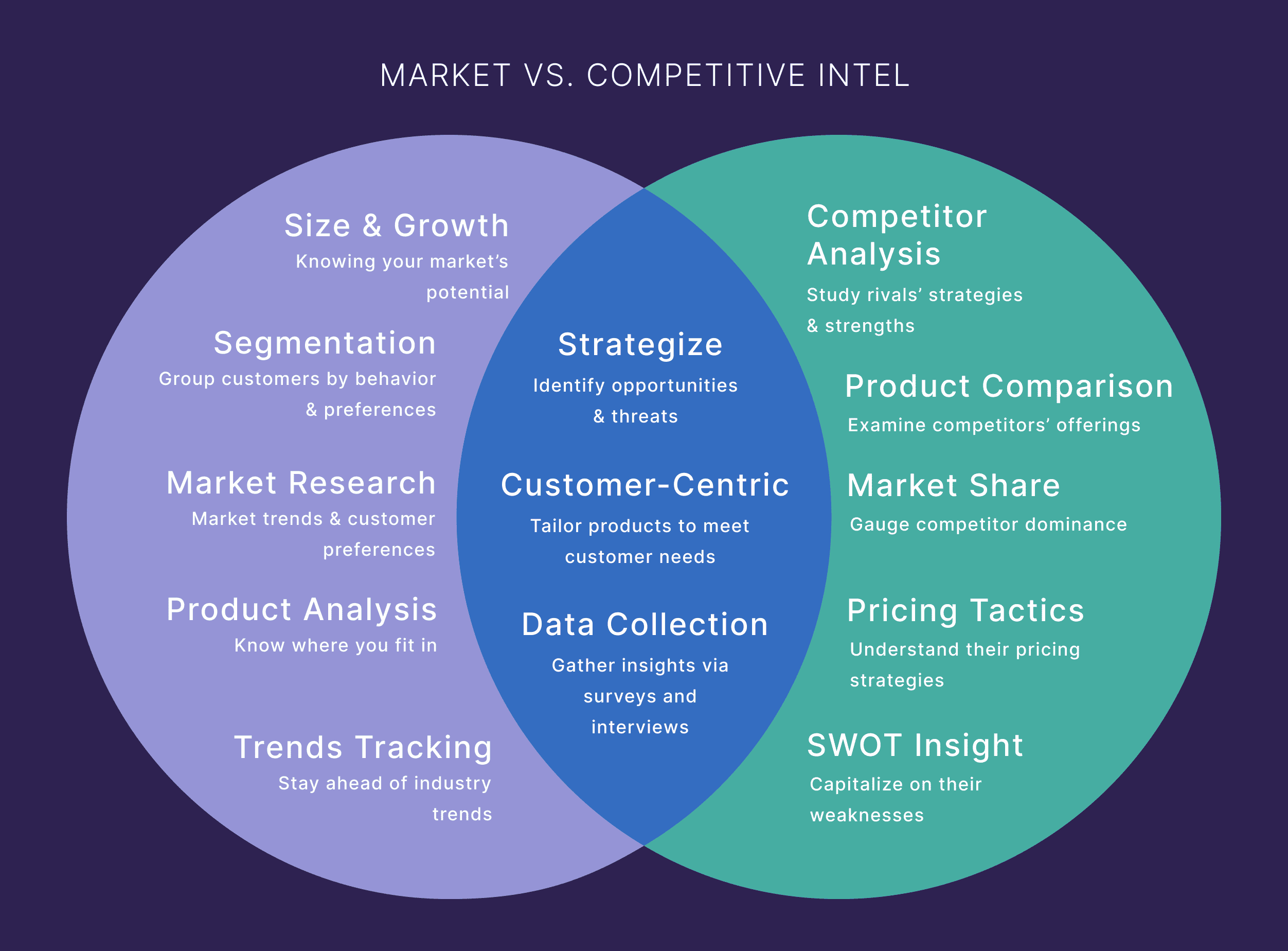

Competitor analysis is often confused with market analysis.

The difference?

A market analysis looks at your whole industry.

A competitor analysis focuses only on the companies you’re directly competing with.

Both are important.

Together, they give you a clearer view of your landscape.

How to Conduct a Competitor Analysis in 8 Steps

Before you start, get clear on your goal.

Are you trying to discover new competitors?

Improve a specific area like pricing, marketing, or customer experience?

Your answers will shape how you approach the process. And what insights matter most.

Once you’ve got that in mind, let’s dive in.

1. Identify and Categorize Your Competitors

To understand your competition, go beyond listing familiar names.

Zoom out to see the full market picture.

Start with a search for terms like “yoga studio in Boston” and note which businesses show up.

Then, check platforms like Reddit, Facebook groups, and review sites to find additional competitors.

Collect the names of these businesses and include their product or service and market segment.

Once you do that, categorize them into direct and indirect competitors:

- Direct competitors: Offer the same service to the same audience

- Indirect competitors: Offer a different service that targets a similar customer base

For example, if you run a yoga studio, another local yoga studio would be a direct competitor.

A gym that recently added yoga classes would be an indirect competitor.

You’re still going after the same people, just with a different offer.

Pro tip: Use our free competitor analysis tool at the top of this page for a quick snapshot of your top competitors.

Want to get more granular?

Use Semrush’s Organic Research tool.

It’ll show you a list of websites directly competing for visibility in search engines.

2. Study Their Customer Segments

To uncover how competitors attract and retain customers, you need to know who they’re targeting. And how.

Start by reviewing their website.

Look at headlines, product pages, and calls to action (CTAs).

Who are they clearly speaking to? Are they targeting small businesses? Busy parents? B2B buyers?

Sometimes, spotting who they’re not targeting can reveal the biggest opportunities.

Take Cirque du Soleil.

While traditional circuses focused on families with kids, Cirque took a different approach.

They targeted adults looking for premium, theatrical experiences.

By identifying the audience their competitors ignored, they created a new category — and owned it.

The result?

Cirque reached over 150 million spectators in 300+ cities and out-earned legacy circuses.

All without ever competing on the same terms.

Once you understand who your competitors are going after, dig into how they’re speaking to that audience.

Are they selling speed? Simplicity? Affordability? A premium experience?

Their messaging will reveal the pain points they believe matter most.

To go even deeper, try a tool like SparkToro.

It can show you what your competitors’ audiences search for, which websites they visit, and which influencers they follow.

This helps you spot content gaps, discover new channels, and sharpen your positioning.

3. Research Their Product or Service

Look into what your competitors actually sell — and how they present it.

Which products or services are featured most? What do they highlight first? What kinds of outcomes or benefits do they emphasize?

This gives you a clear picture of their priorities, strengths, and blind spots.

Examine their website’s navigation, homepage banners, and product pages.

Are they pushing bundles? Limited editions? Seasonal drops? Subscription options?

Note how they position their offerings. Is it through innovation, price, simplicity, or something else?

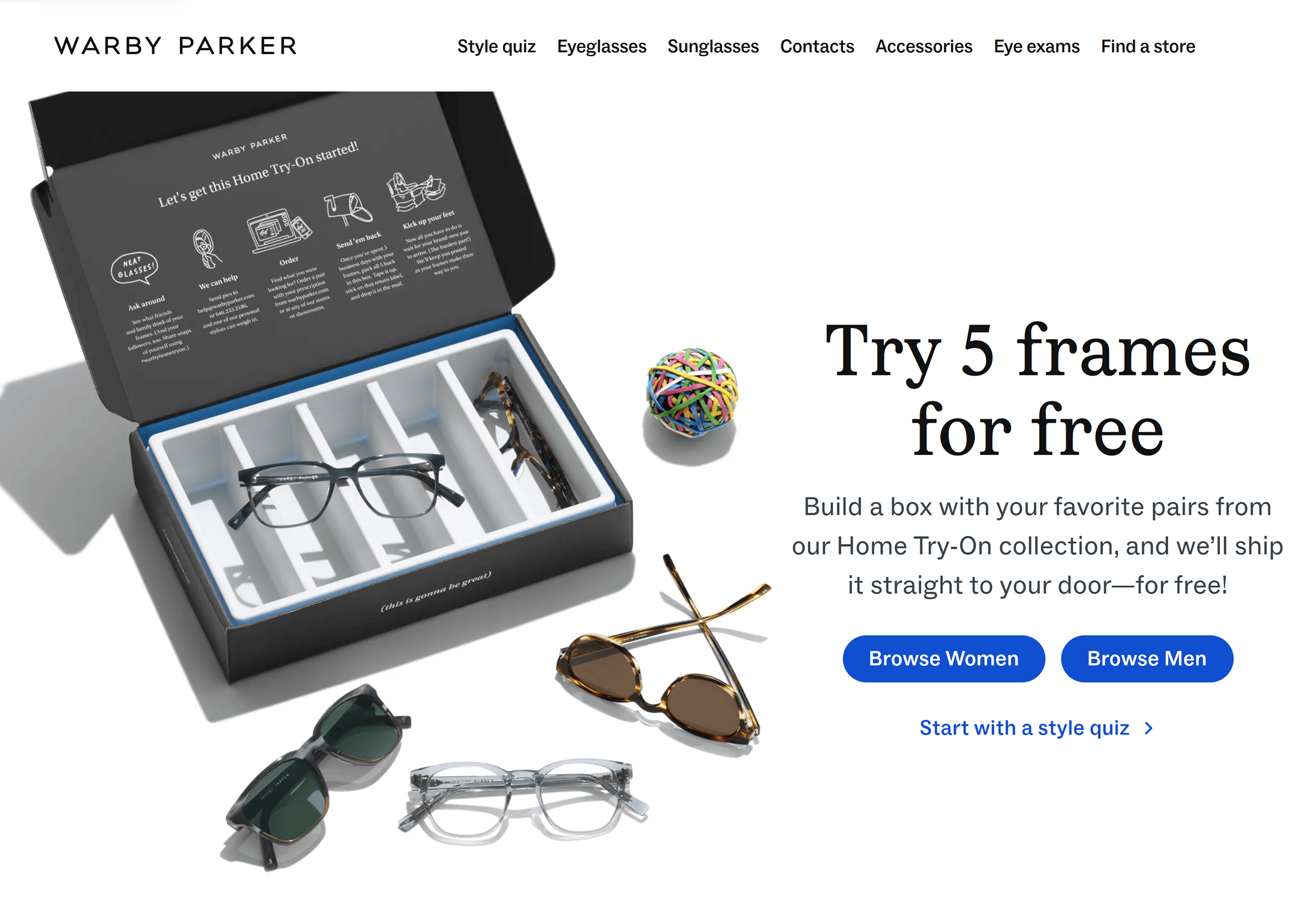

Warby Parker is a great example of this in action.

When they entered the eyewear market, they saw a problem.

Traditional brands made buying glasses online clunky and uncertain.

Their solution?

A free home try-on program that lets customers test five frames from home.

That single feature removed a major friction point — and helped them stand out in a crowded industry.

It wasn’t just the product that made them successful.

It was how they delivered and positioned it.

4. Observe How They Price Their Product or Service

Pricing isn’t just about cost.

It signals value, positioning, and business strategy.

When you study your competitors’ pricing models, you’ll start to see what the market expects — and where there’s room to move.

Ask questions like:

- What pricing model do they use (freemium, flat rate, tiered)?

- Do they offer bundles, subscriptions, or add-ons?

- Are they positioned as a budget-friendly or premium option?

- How transparent are they about pricing?

- Do they offer discounts, limited-time deals, or sliding scales?

- What exactly do customers get at each price point?

Take Dollar Shave Club, for example.

When they studied competitors like Gillette, they spotted a gap.

Most brands were charging $15–$20 for razors with features users didn’t even care about.

So they went the other way: $1/month for a starter kit, delivered by subscription.

Their pricing wasn’t just lower. It was strategic.

It simplified the offer, eliminated decision fatigue, and signaled a no-nonsense value prop that instantly resonated.

That clarity and contrast helped them rapidly scale and led to a $1B acquisition by Unilever.

Pro tip: Check pricing pages in incognito mode or from a mobile device. Some brands test different offers or discounts based on device, location, or referral source.

5. Analyze Their Marketing Strategy

Marketing reveals more than just promotion.

It shows you where your competitors are investing time and money.

By tracking their activity, you can spot what channels they rely on, what messages they repeat, and where they’re likely seeing results.

Pinpoint Their Main Channels

Start by scanning their website, search results, and social profiles.

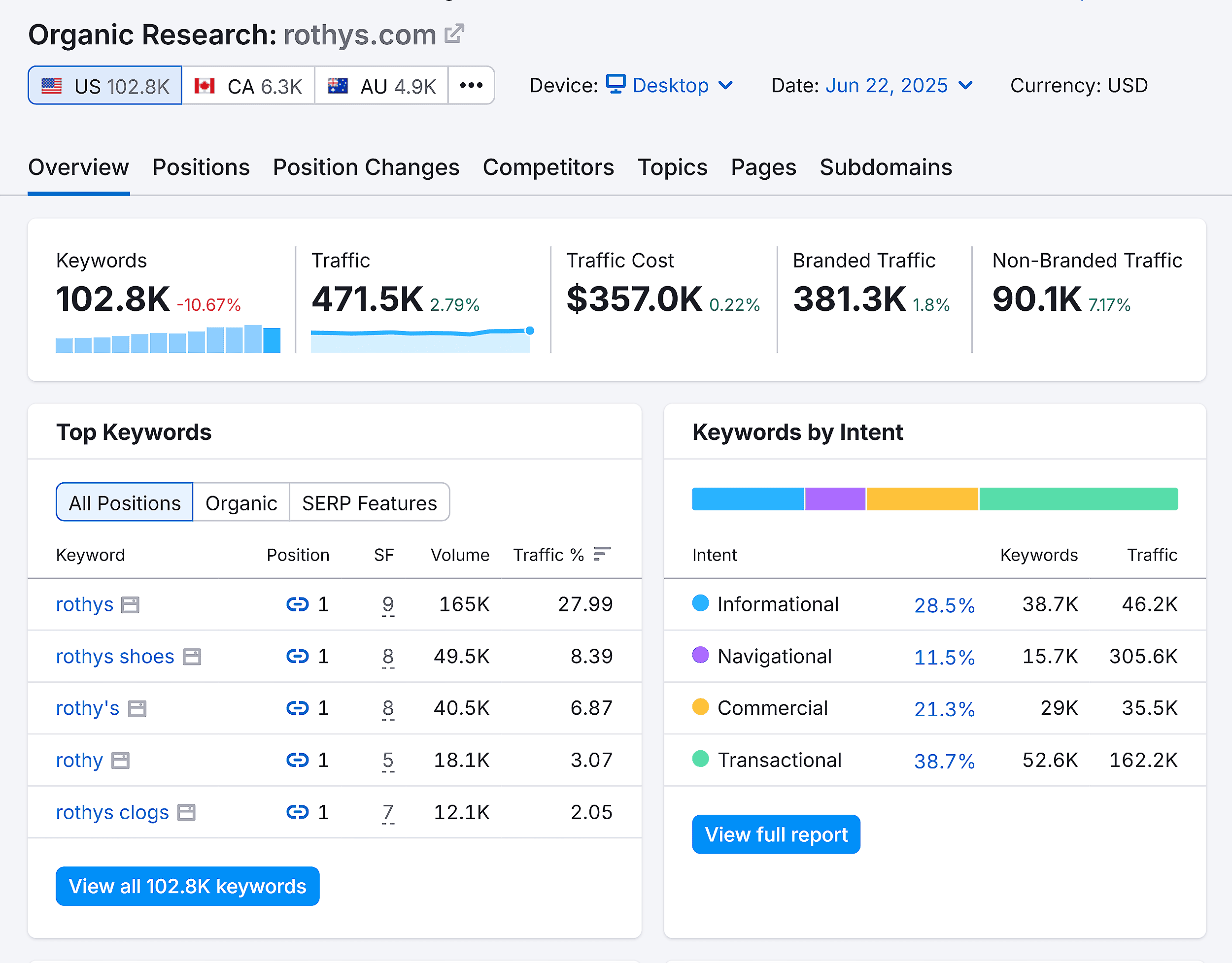

For example, a quick Google search for Rothy’s tells you a lot.

They show up in Google Ads, organic listings, Amazon, Instagram, Facebook, YouTube, and even Reddit.

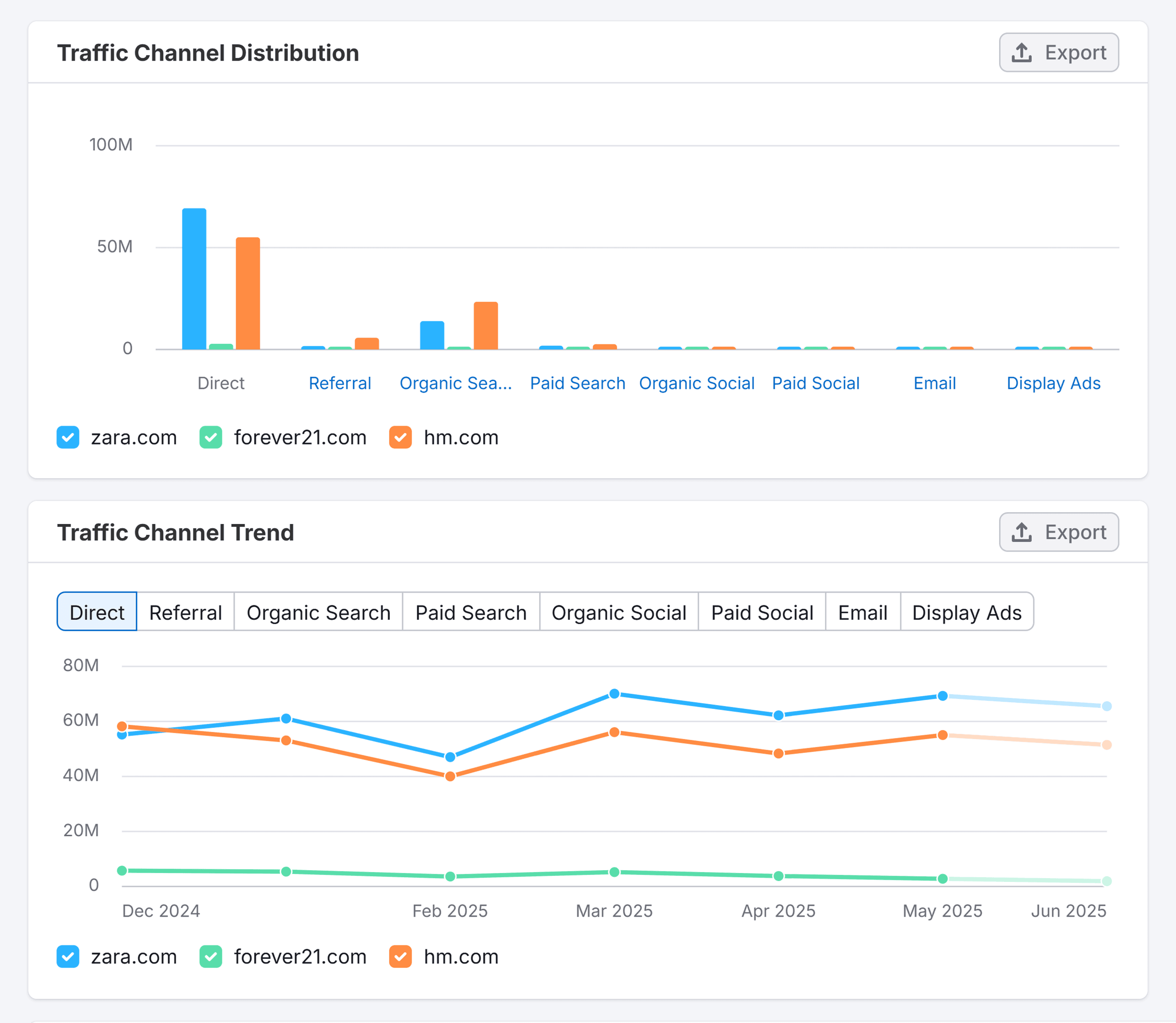

For a deeper dive, use Semrush’s Traffic & Market toolkit.

This competitor analysis tool can show you which channels are driving the most visibility — whether it’s organic search, paid traffic, or referrals.

That tells you where they’re investing and which platforms matter most to their growth.

If you notice consistent presence across a few channels, it’s a sign those platforms are driving results. And worth exploring for your own strategy.

If they’re active in some places and silent in others, that could reveal blind spots you can take advantage of.

Break Down Their Messaging and Strategy

Once you know where they’re active, take a closer look at how they present their offer.

Are they emphasizing price, speed, luxury, simplicity, or something else?

Do they lean into social proof, brand values, or heavy discounts?

What kind of tone are they using — premium, casual, direct?

Review their headlines, product pages, ads, and emails.

Then, look at what they’re trying to rank for.

Use Semrush’s Organic Research tool to see which keywords

drive the most traffic to their site.

Enter your competitor’s URL, select the region, and click “Search.”

The tool gives you a detailed look at your competitor’s organic search performance.

You’ll see their top-ranking keywords, traffic volume, and more.

Are they focusing on comparison keywords? Branded terms? Problem-based queries?

Pair that with the rest of their messaging, and you’ll start to see which angles they’re betting on — and which ones they’re ignoring.

Further reading: SEO Competitor Analysis

6. Map Out Their Customer Journey

Start by going through the experience like a real customer.

Click on one of their ads. Browse their homepage. Sign up for their email list. Try to make a purchase.

Pay attention to how smooth — or clunky — each step feels.

Look for:

- How they structure their homepage and product pages

- Whether CTAs are clear and guide you forward

- Friction points in the checkout or sign-up process

- Post-purchase flows like confirmation pages, surveys, or upsells

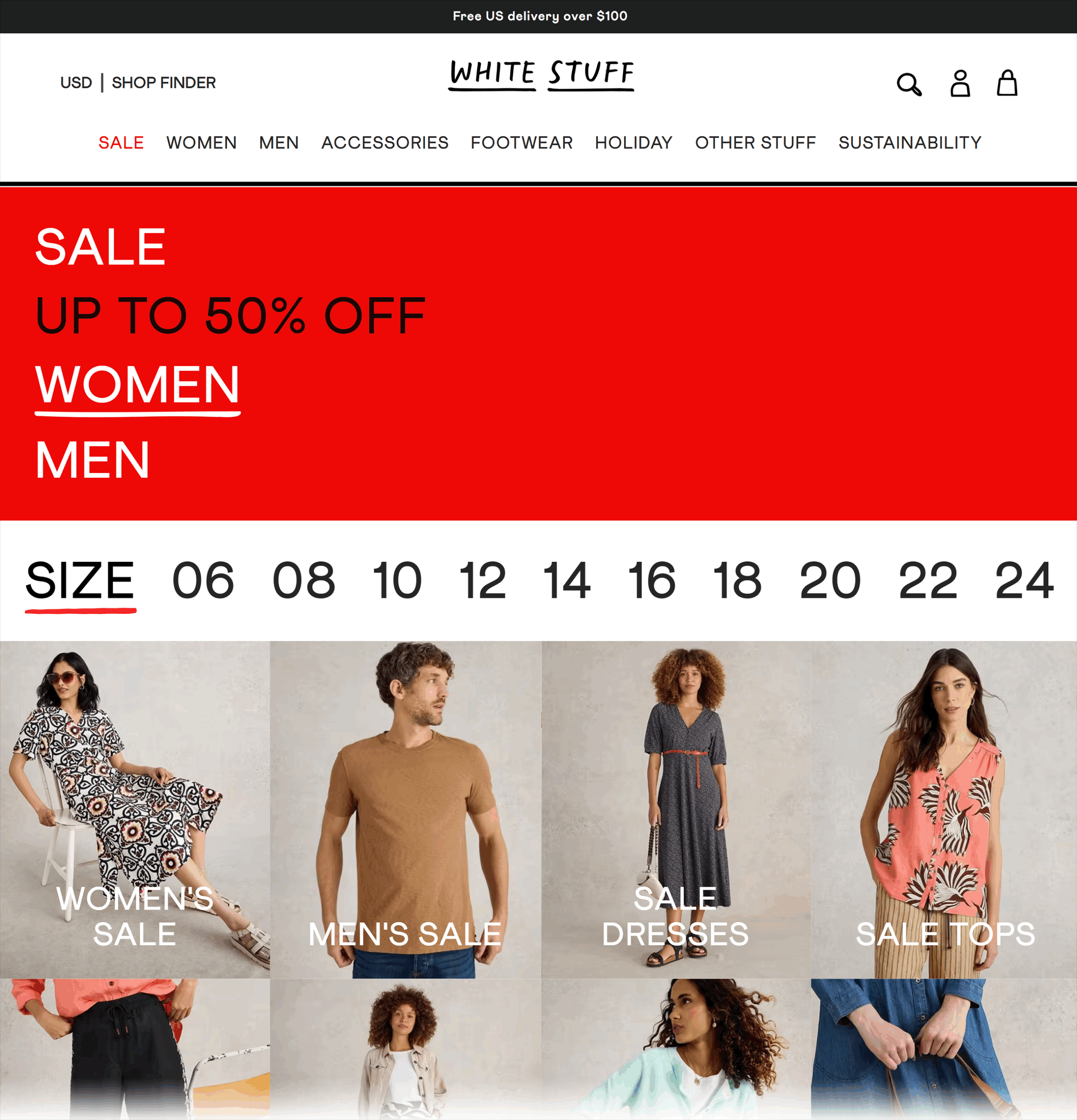

For instance, ecommerce fashion brand White Stuff ran a competitor analysis.

They looked at their checkout process versus similar retailers and spotted a problem.

While others had streamlined, single-page flows, theirs was still spread across three clunky steps.

So, they tested a one-page checkout.

The impact?

A 37% boost in conversions and a 26% increase in average order value.

A small change, but one that removed friction and paid off fast.

Want to spot similar gaps in your rivals’ customer journeys?

Use a competitor checker like Unkover to automatically track their email flows.

You’ll get all their educational and promotional emails, so you can see how they market their products in real time.

Use what you learn to spot weak points and improve your own flow.

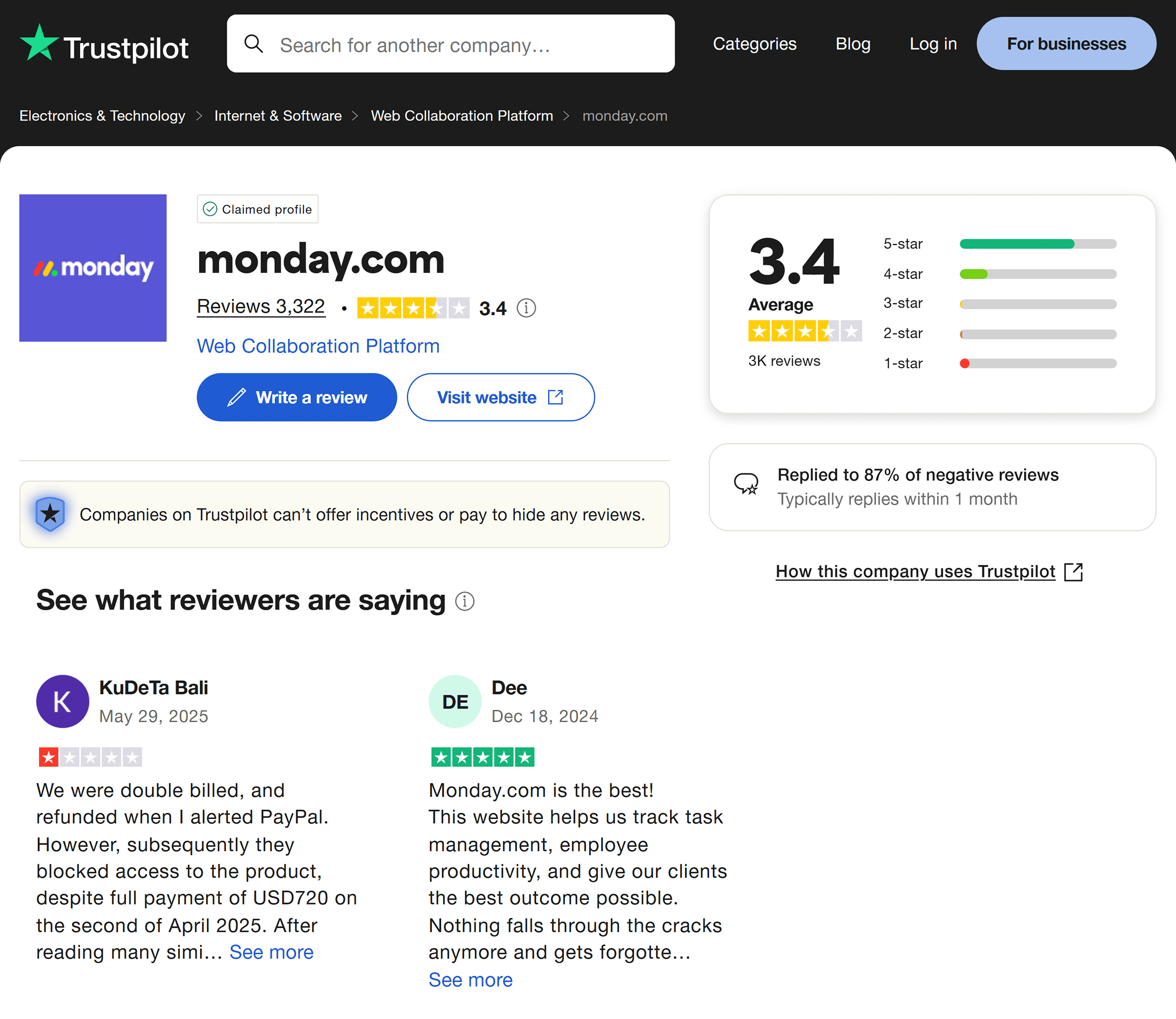

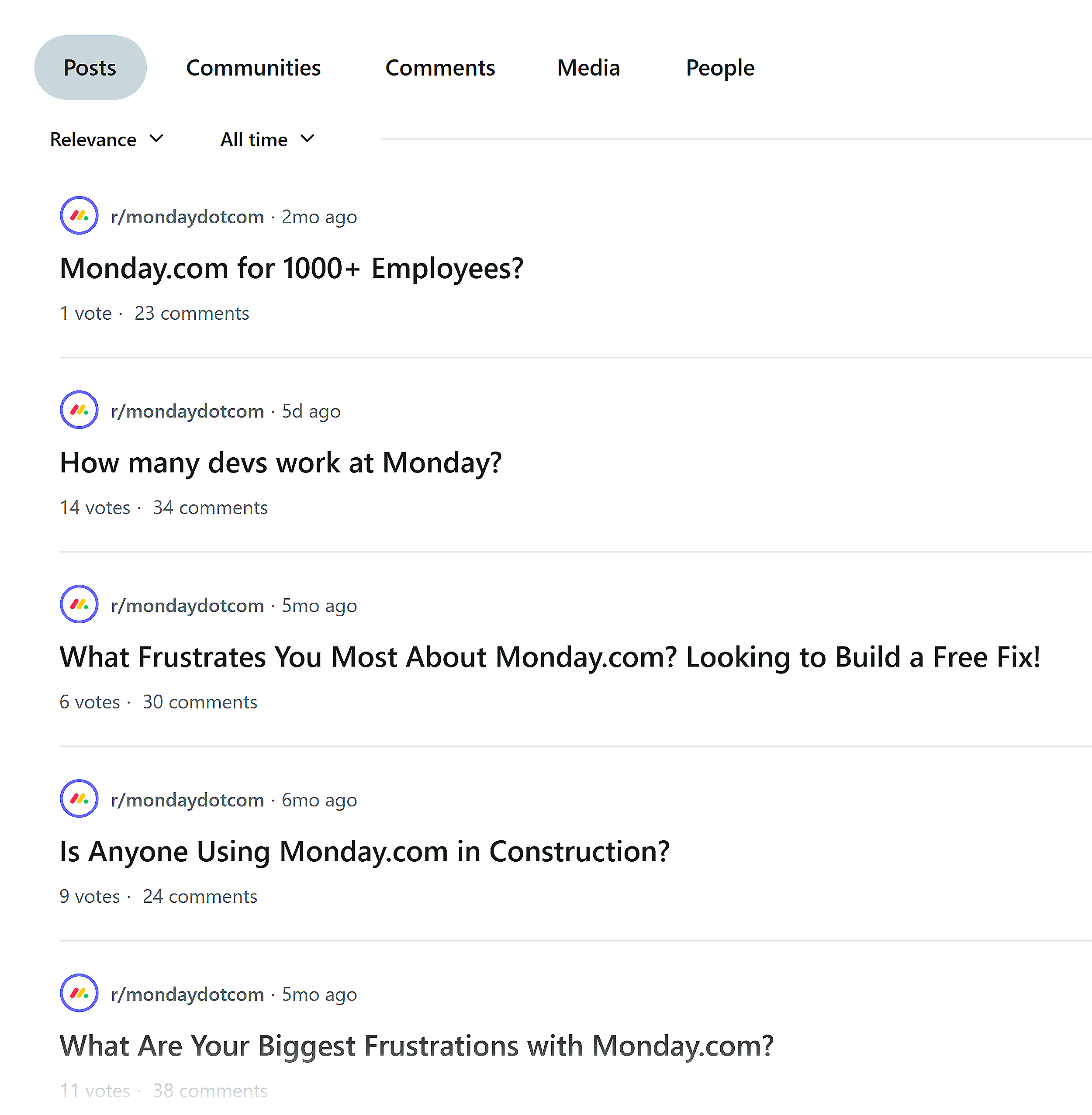

7. Learn What Their Customers Are Saying

What customers say about your competitors can reveal more than any product page or press release.

It shows you what real users care about. And where competitors are falling short.

Start by checking public reviews on platforms like G2, Trustpilot, Amazon, or industry-specific directories.

Look for patterns in what people praise or complain about.

Are they raving about speed? Complaining about support? Confused by pricing?

You can also scan social channels like Reddit or X.

Andy McCotter-Bicknell, head of competitive intelligence at Apollo.io, has an unusual way to contact a competitor’s customers.

He just messages them.

“There have been multiple research projects where I’ve messaged competitors’ customers on LinkedIn or via email asking for info. And I’m surprised how willing folks are each time to share their thoughts. As long as you’re transparent about who you are and who you work for, this should be a no-brainer.”

Turn common complaints into talking points.

If users hate slow support, highlight your response time.

If they’re confused about pricing, show how yours is simpler.

Use their words to your advantage. 8. Categorize Your Findings Using SWOT Analysis

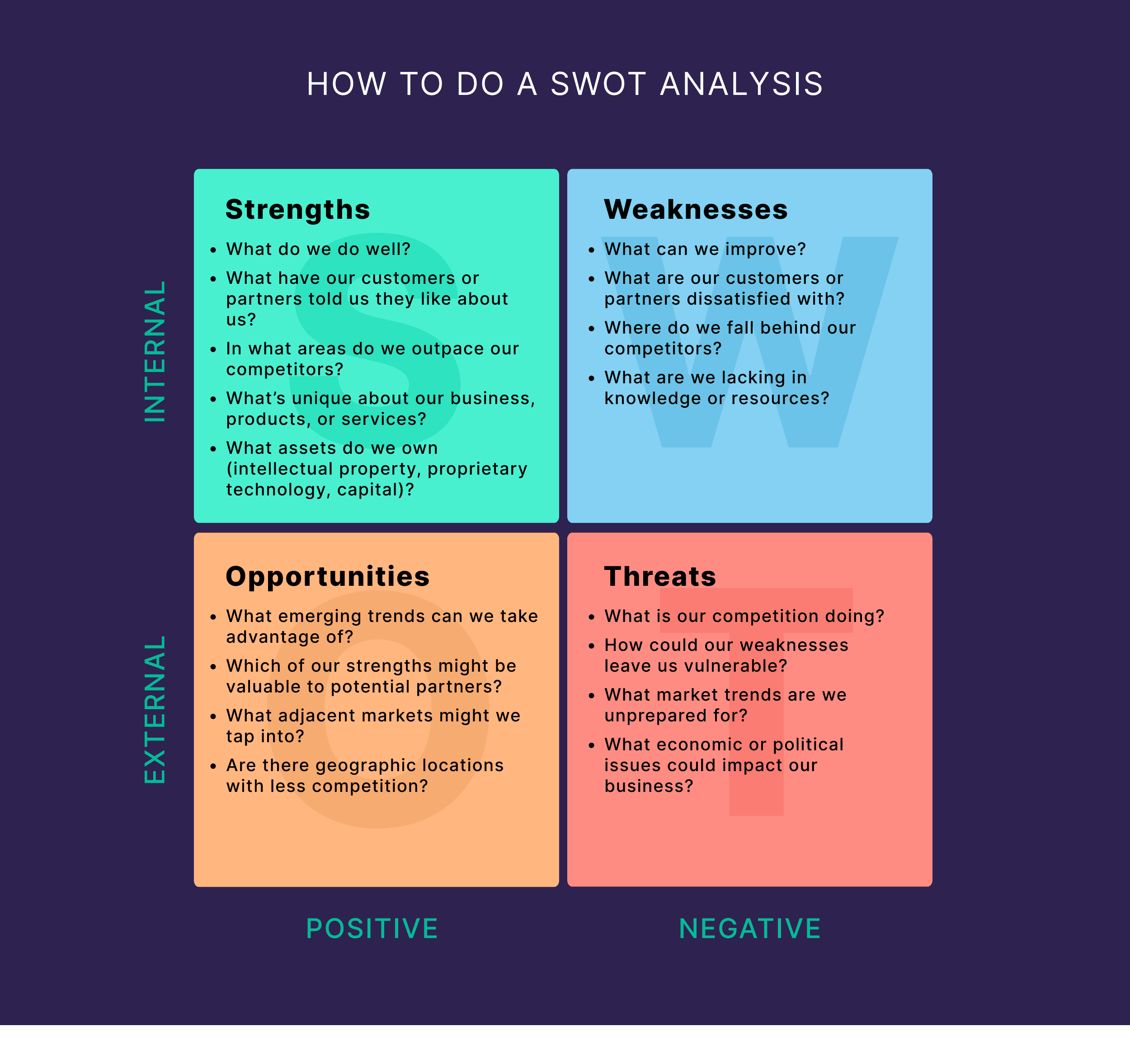

8. Categorize Your Findings Using SWOT Analysis

Once you’ve gathered insights from the previous steps, bring everything together using a SWOT analysis.

Break it down:

- Strengths: Where do you win? Think brand loyalty, customer satisfaction, and operational efficiency.

- Weaknesses: What’s slowing you down? Inventory issues, underperforming products, or weak positioning.

- Opportunities: What trends or unmet needs can you take advantage of? Look to customer shifts, tech gaps, or whitespace in your category.

- Threats: What risks or external pressures could undermine you? Competitors, costs, or market changes.

Pro tip: Don’t overthink it. Focus on 3–5 in each category and make sure they’re honest. This isn’t a branding exercise. It’s a strategy one.

When done right, a SWOT analysis doesn’t just highlight what’s going on. It tells you what to do next.

Take Domino’s, for example.

In early 2024, the company used a SWOT analysis to rethink its global strategy.

The review flagged key weaknesses, like an overly pizza-centric menu and heavy reliance on U.S. franchise sales.

It also surfaced clear opportunities. Expand internationally, innovate healthier menu items, and double down on digital ordering.

Domino’s acted fast.

They rolled out new health-conscious offerings, accelerated global store openings, and invested heavily in app and delivery tech.

Within months, global retail sales rose 7.3% and U.S. same-store sales climbed 5.6%.

That’s the power of turning analysis into action.

The kind of momentum that only comes when your competitor analysis moves off the page and into execution.

Turn Your Insights Into Action

Once you’ve mapped your SWOT, the guesswork is gone.

You’ve got a focused list of what matters. And where to move next.

Start by zeroing in on the signals that count. Not every insight deserves equal weight.

Some strengths are worth doubling down on immediately.

Some weaknesses can wait. Others can’t.

Look for opportunities with real momentum behind them and threats that are more than just hypotheticals.

From there, shape your next moves into a simple 90-day plan:

- Pick 2–3 plays with clear upside

- Assign ownership and deadlines

- Define what success looks like

- Start small, then scale what works

This isn’t about building a five-year strategy. It’s about turning insight into traction.

That’s exactly what Domino’s did.

They didn’t try to fix everything at once. They picked their shots and moved fast. The results followed.

Pro tip: Don’t wait for the perfect plan. Run a small test based on your top insight—fast feedback beats flawless strategy every time.

Monitor Your Competitors to Stay Ahead

Competitive research isn’t a one-and-done task.

Set a regular cadence — monthly or quarterly, depending on how fast your industry moves — and run this process on repeat.

The more consistently you track your competitors, the easier it is to spot shifts early and stay ahead.

Ready to start researching your rivals?

Use this spreadsheet template to document your findings and stack your business up against the competition.