Audience Research: Stop Guessing What Your Buyers Care About

Written by Shreelekha Singh, Leigh McKenzie

If I had a dollar for every time someone said “know your audience,” I could retire from marketing altogether.

And yet, most teams are completely winging it.

Too often, marketers equate audience research with half-baked customer relationship management (CRM) data, some social media metrics, and a few buyer interviews.

But that’s just organizing information you already have.

Real audience research means discovering what you don’t know yet.

It’s the exact words people use when they’re frustrated. The solutions they’ve already tried and dismissed. The moment they decide to trust one source over another.

When you get this right, you move from guessing what might work to creating content from what your audience is already telling you.

In this guide, I’ll show you how to find those insights across five key channels, with practical tactics you can use right away.

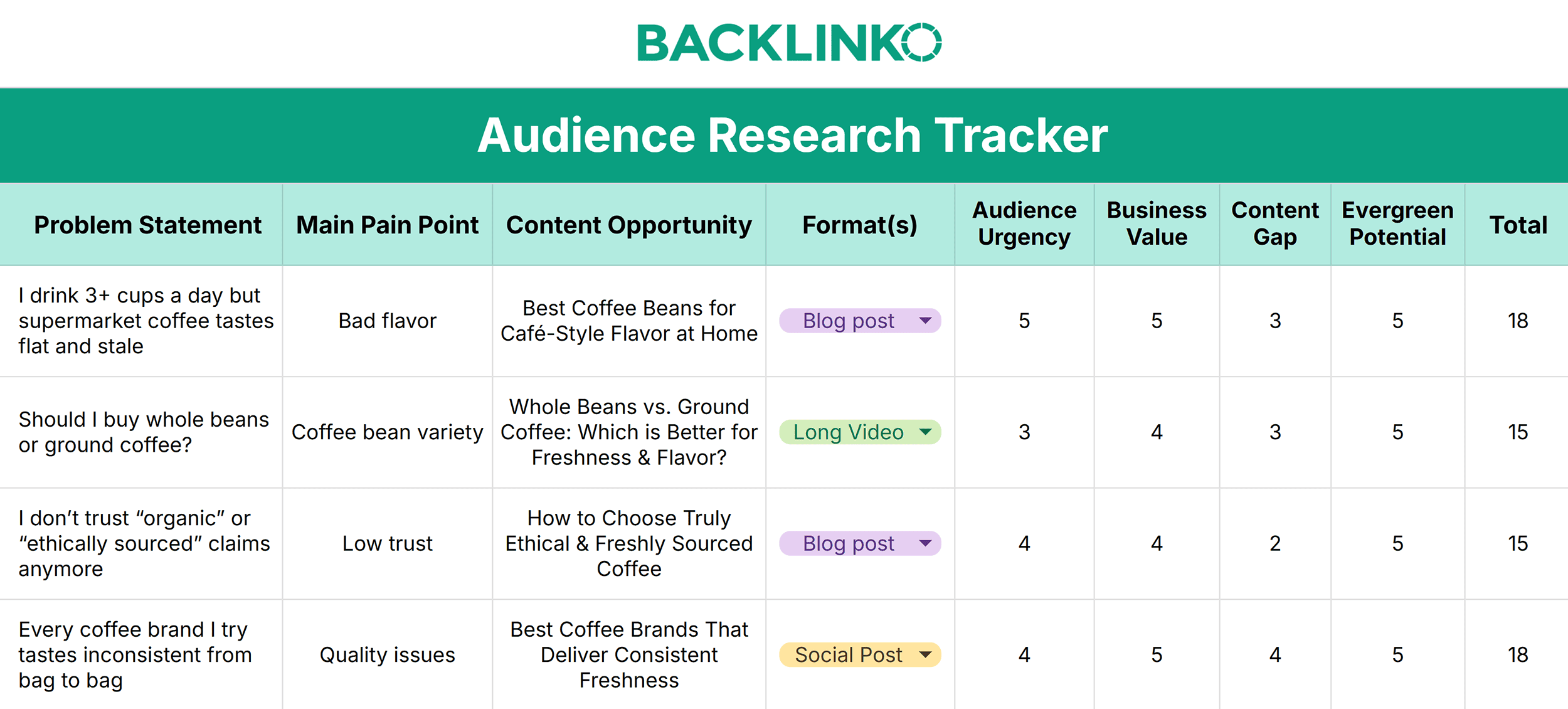

Download our free Audience Research Tracker

As you go through these methods, I’ll show you how to capture insights in our Audience Research Tracker and turn them into actionable content ideas.

Why You Can’t Skip Audience Research

If you’ve ever lost hours scrolling TikTok or binge-watched “just one more episode” on Netflix until midnight, you’ve experienced the power of audience research.

Platforms like Netflix, YouTube, and TikTok own our attention because they know us better than we know ourselves.

They’ve built this advantage by making audience research a core function.

Netflix, for example, treats “Consumer Insights” as one of its nine core research areas, which shows just how pivotal understanding users is to their success.

For these winning brands, audience research isn’t an afterthought.

It shapes everything: what gets built, how products are positioned, and which messages resonate

And the payoff is massive — delivering experiences tailored to your customers that keep them coming back for more.

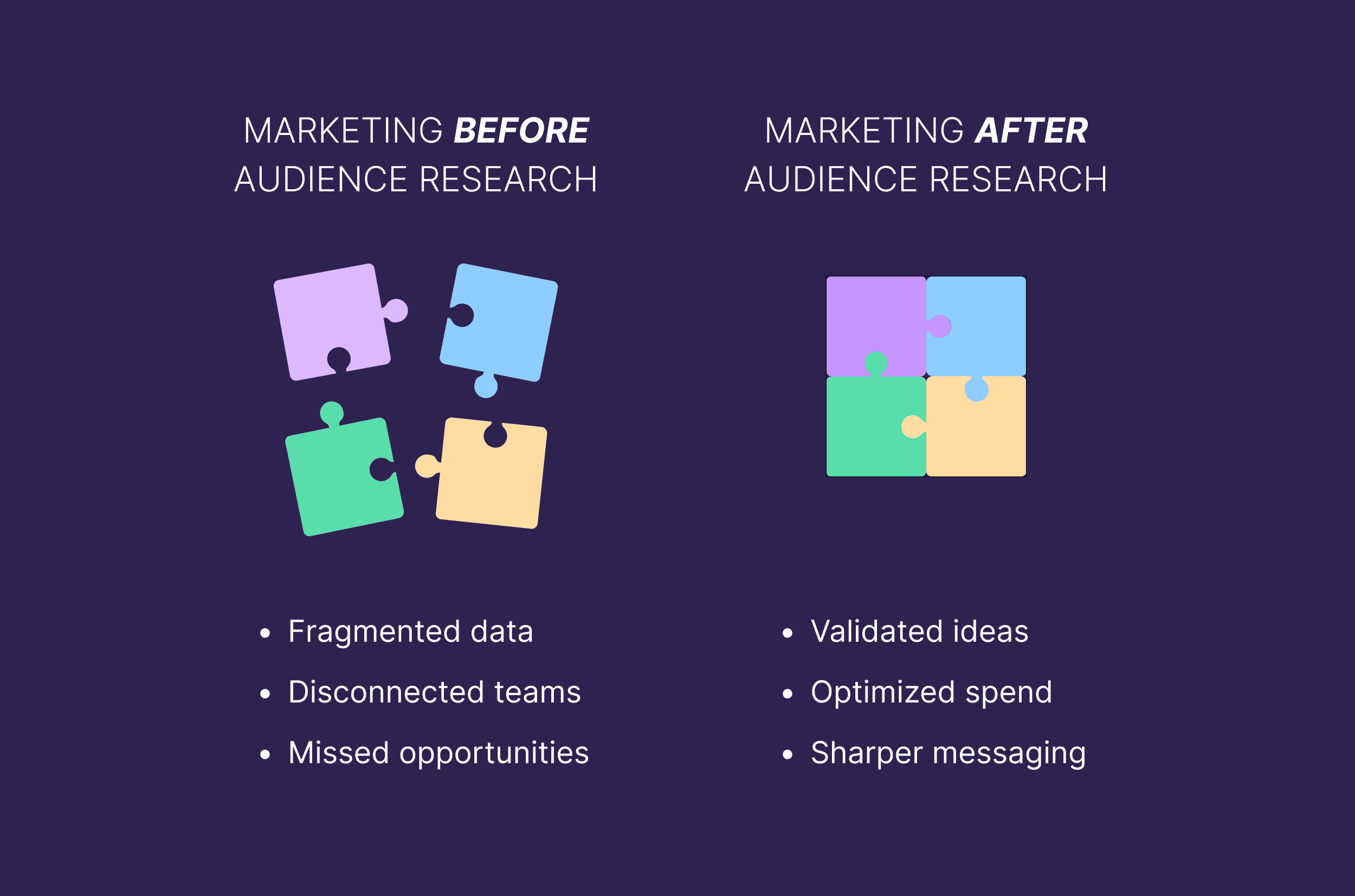

In stark contrast, many marketing teams run on fragments.

SEOs chase keywords, social focuses on engagement, and product marketing fine-tunes messaging. Everyone has a piece of the puzzle, but no one can put it together.

As a result, campaigns are designed for specific channels instead of real people.

Done well, audience research can close this gap to:

- Sharpen your messaging that customers find relatable

- Prevent wasted spend by showing you where people actually are

- Speed up creative cycles by giving teams validated insights to work with

In short: This research legwork aligns marketing with real customer needs, winning customer trust in the process.

And the good news is you don’t need Big Tech’s expensive resources to pull this off.

I’ll show you how to conduct audience research and out-empathize the competition with your existing team and budget.

5 Channels to Conduct Audience Research for Content Marketing

Your buyers are already telling you what they want. You just need to listen carefully.

Let’s learn how.

Make sure to download our tracker and jot down all the information from your audience research techniques.

Tap Into Intel Within Your Company

Some of the most valuable audience insights are already within your reach, sitting with your sales and customer success (CS) teams.

These groups are on the front lines.

They regularly interact with prospects and customers about their frustrations, aspirations, objections, and goals.

For marketers figuring out how to conduct audience research, collecting these insights is a great starting point.

Here’s how:

| Source of Insight | How It Works | What You’ll Learn |

|---|---|---|

| Listen to conversations |

|

|

| Sync with frontline teams |

|

|

| Interview & survey customers |

|

|

Listen and Capture First-Hand Conversations

The fastest way to understand your audience is to literally listen.

Sit in on a sales demo, a customer onboarding call, or a quarterly check-in meeting.

This will bring you raw insights you can’t get from surveys, like:

- The way buyers frame their challenges

- The decision factors they prioritize

- The words they repeat

But listening alone isn’t enough.

You need a simple system to document the key takeaways from every conversation and share them across teams.

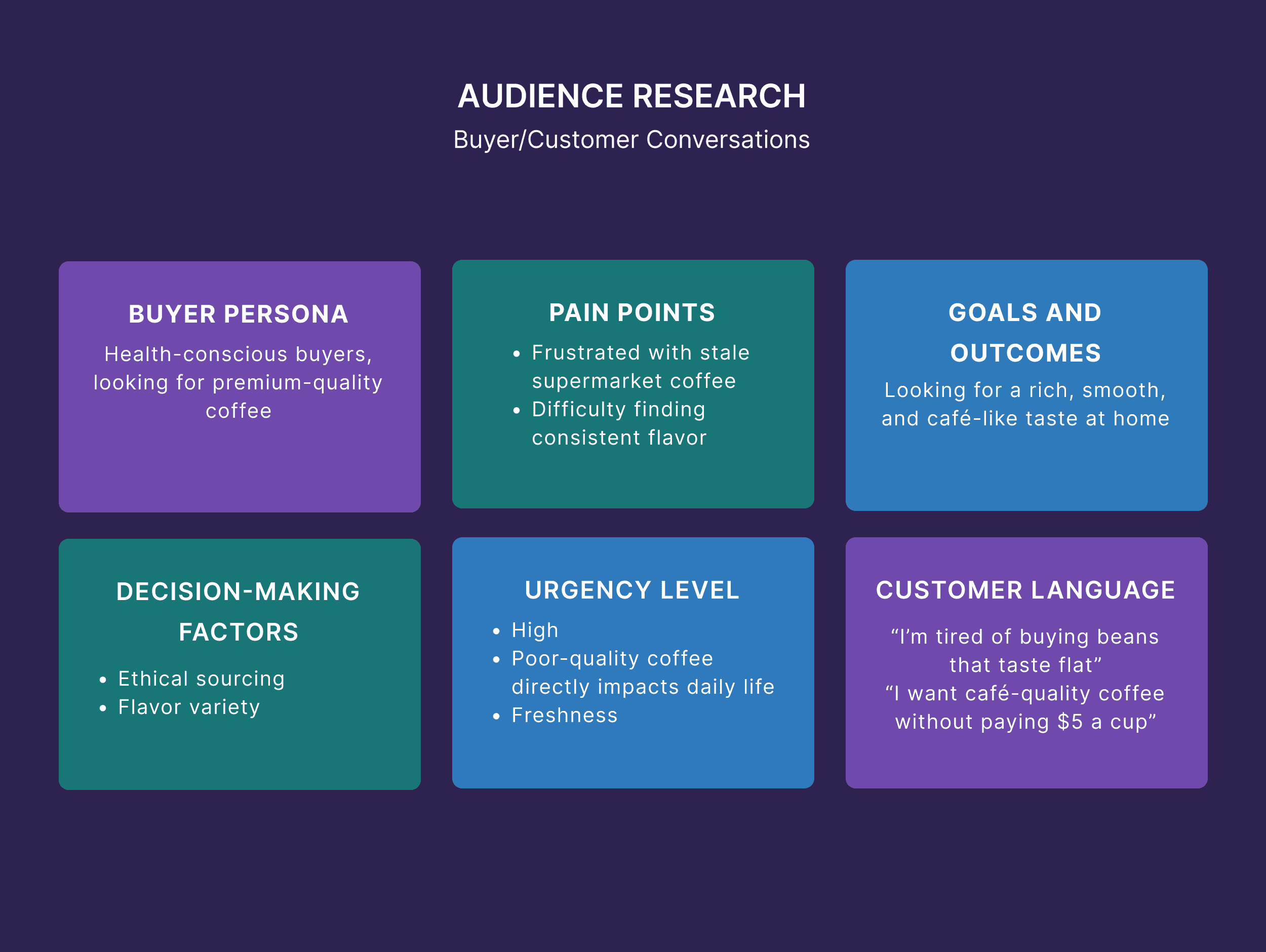

Here’s an example of what that might look like for a fictional coffee brand:

Our Audience Research Tracker will help you distill these conversations into meaningful content opportunities.

You can jot down recurring problem statements in your buyers’ language and identify their biggest pain points.

Then, prioritize ideas based on our four key parameters like urgency, business value, and more.

Sync with Frontline Teams

Another way to capture these insights is by regularly connecting with your customer-facing teams.

When teams work in silos, each one only sees a part of the puzzle.

This creates a disconnect in your customer experience because no one has the whole picture of what buyers want.

That’s why it’s worth setting up regular cross-team sessions for marketing, sales, customer success, and product teams to compare notes.

These sessions can surface insights that no single team could uncover on its own.

Interview and Survey Customers

Besides internal data, hearing directly from buyers can give you a deeper, more reliable understanding of what drives their decisions.

Customer interviews provide essential context about the why behind their behavior.

You can find out:

- How they first discovered your product or category

- What pain points pushed them to look for a solution

- The decision-making process they followed

- What alternatives did they consider

With surveys, you can validate these insights and see which ones apply broadly versus one-off anecdotes.

The bottom line: Before spending anything on new research, look inward to collect and process information you already have.

Use Reddit for Unfiltered Conversations

Unlike other social media platforms, Reddit gives you access to candid and often brutally honest conversations.

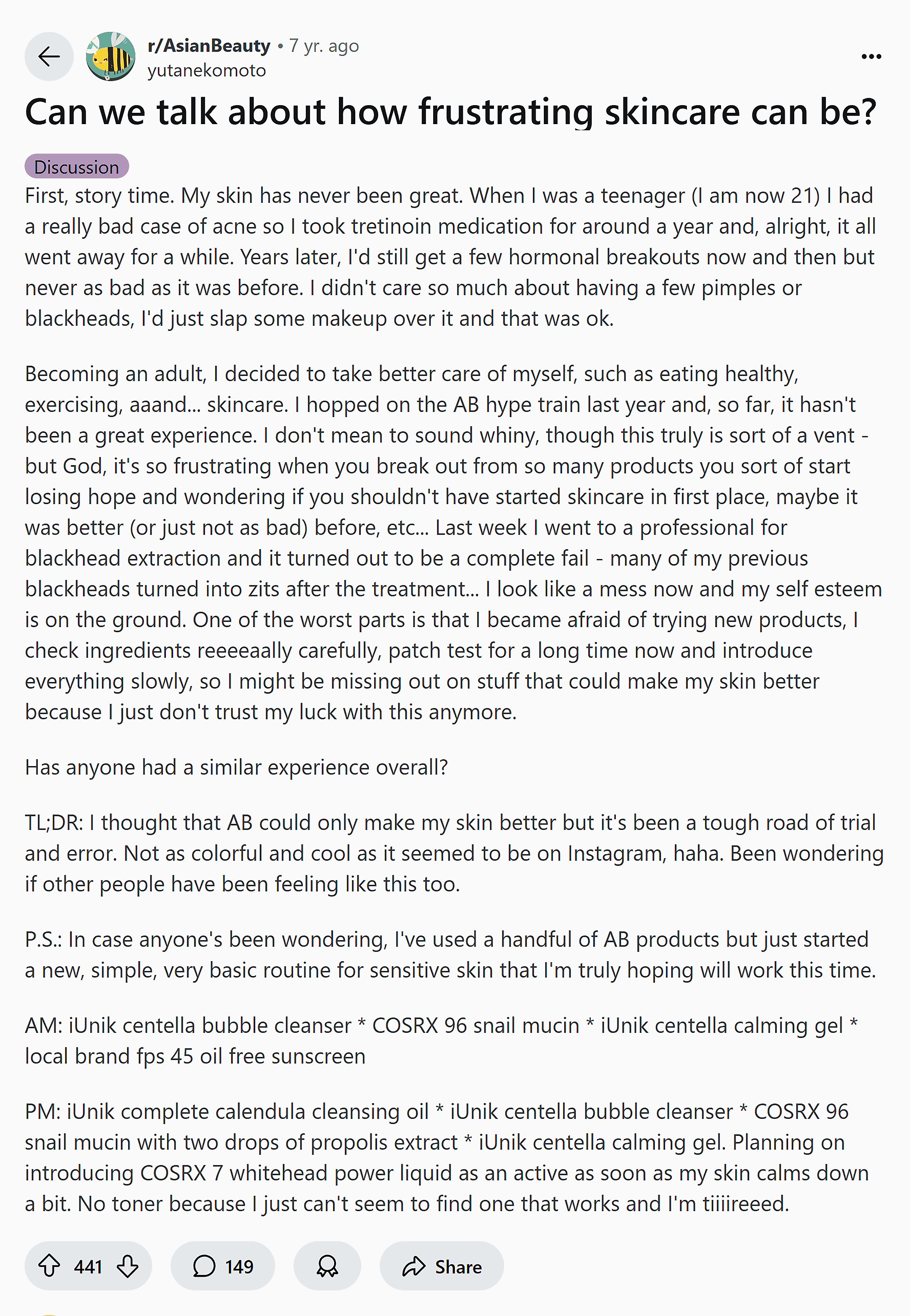

Take this post on frustrating skincare routines.

It voices raw and real emotions that people face when dealing with skincare challenges.

And in the comments, there are even more stories and nuanced perspectives.

They offer crucial insights about the audience, like “skincare feels like a tough road of trial and error” and the “emotional toll of poor skin health.”

So, how do you use Reddit to know your buyers better?

Start with the Right Filters

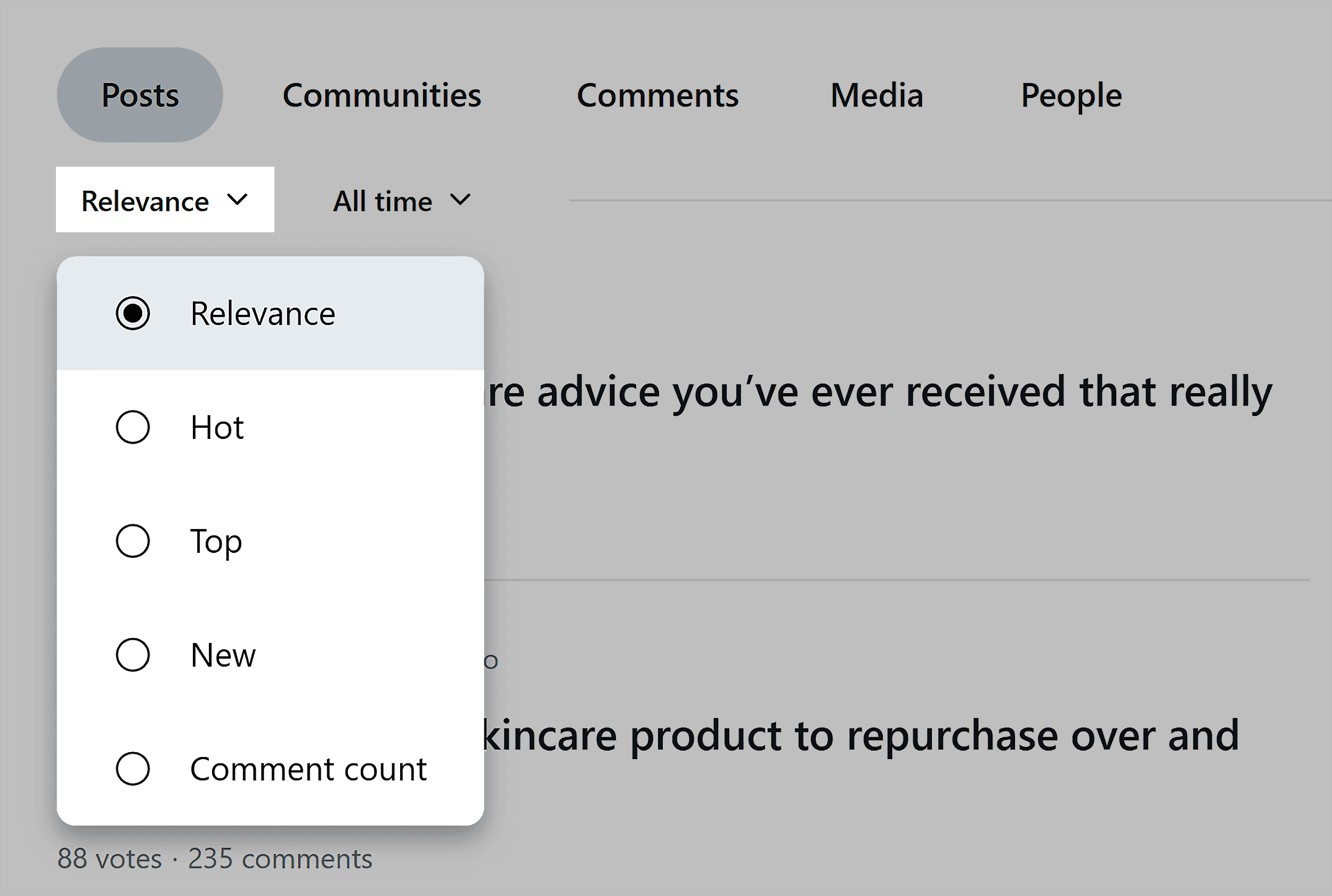

Reddit’s filters make it easy to sift through posts and find what matters most.

You can sort results by:

- Relevance: Best for finding posts that match your keyword directly

- Top: Surfaces the most upvoted posts over a time period

- Hot: Shows recently trending posts with the most upvotes

- Comment count: Sorts posts with the most comments

- New: Shows you the freshest discussions

Plus, you can filter results by timeframe to see what’s trending now versus what’s been a consistent pain point over time.

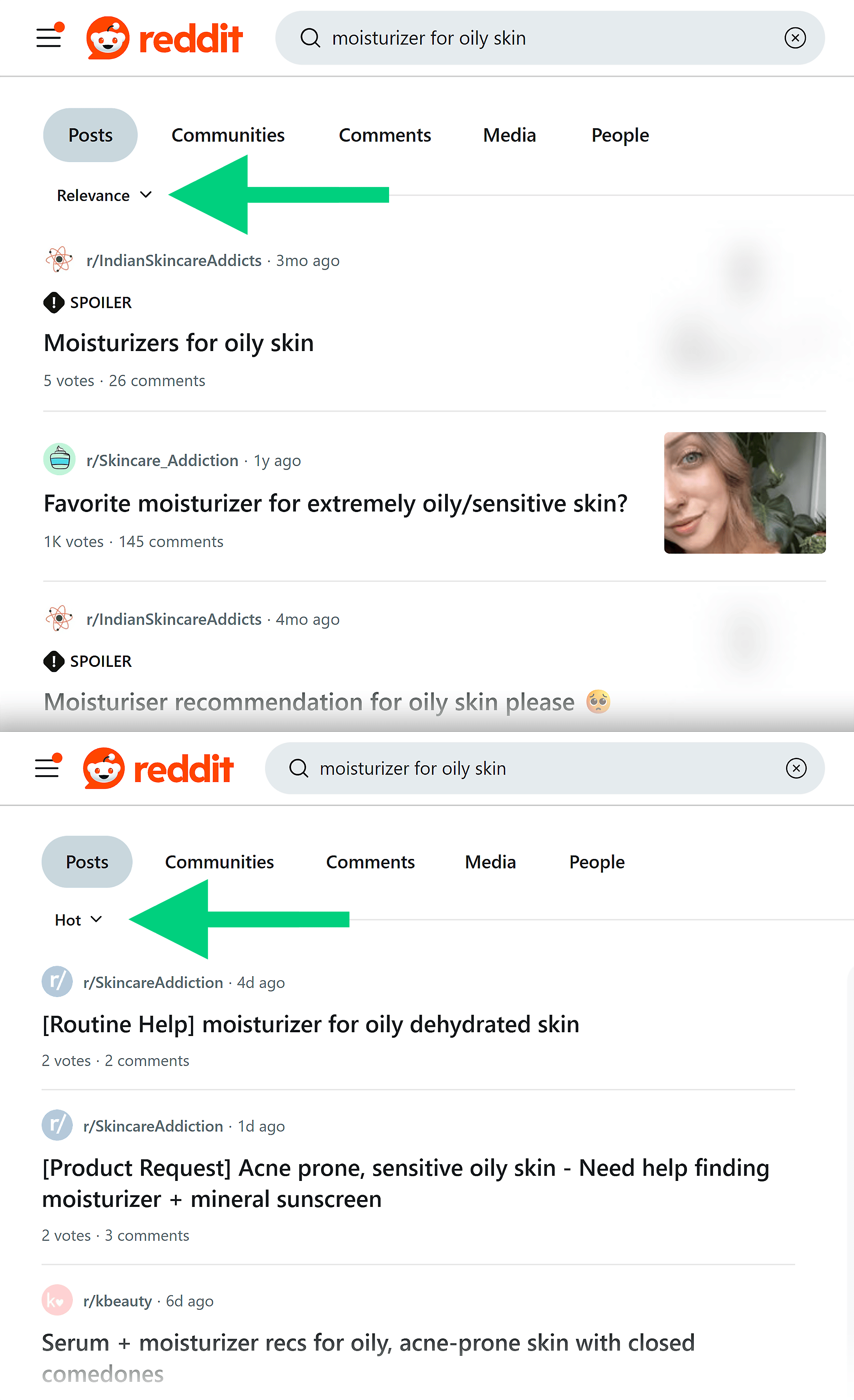

In my search for “moisturizer for oily skin,” filtering by “Relevance” shows the closest matches, while “Hot” surfaces the most recently upvoted posts.

Pro tip: Use Google with the search operator site:reddit.com “keyword.” This often works better than Reddit’s native search, especially if you’re looking for niche phrases.

Find the Right Subreddits

While it’s easy to find bigger and popular subreddits, it’s equally important to look for smaller, niche spaces where your audience might hang out.

Remember, the same buyers may express themselves differently depending on the space they’re in.

For instance, a skincare brand could find valuable insights across:

- r/SkincareAddiction: Broad, general skincare conversations

- r/AsianBeauty: Discussions centered on Asian markets

- r/30PlusSkincare: Catering to an older demographic

Each subreddit reflects a different slice of the audience.

Read Posts and Comments Like a Researcher

A good Reddit post will give you context into people’s problems, goals, and lived experiences.

But the comments add more nuance to the original post. This is where people expand on the issue, discuss solutions, and share personal stories.

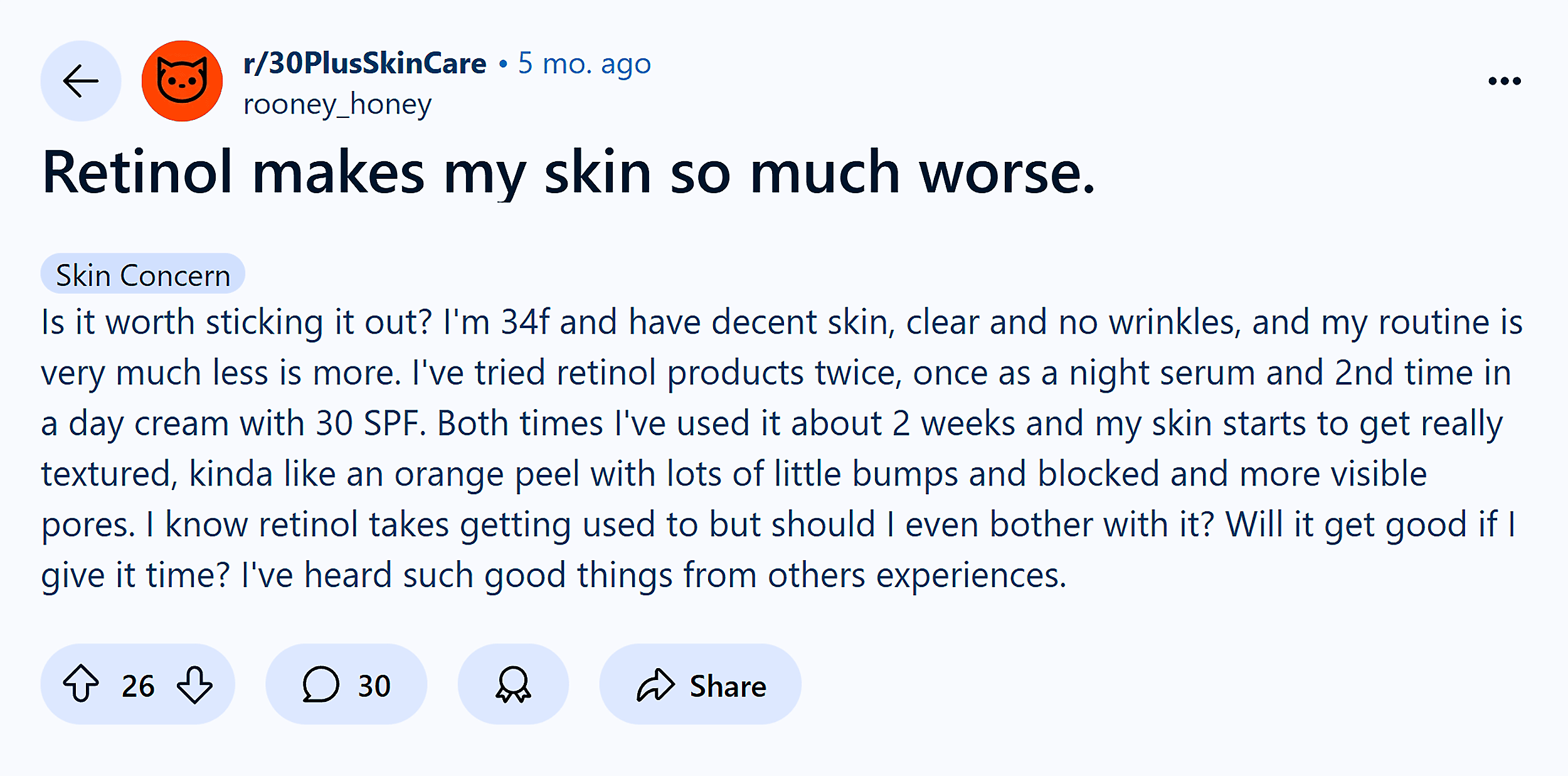

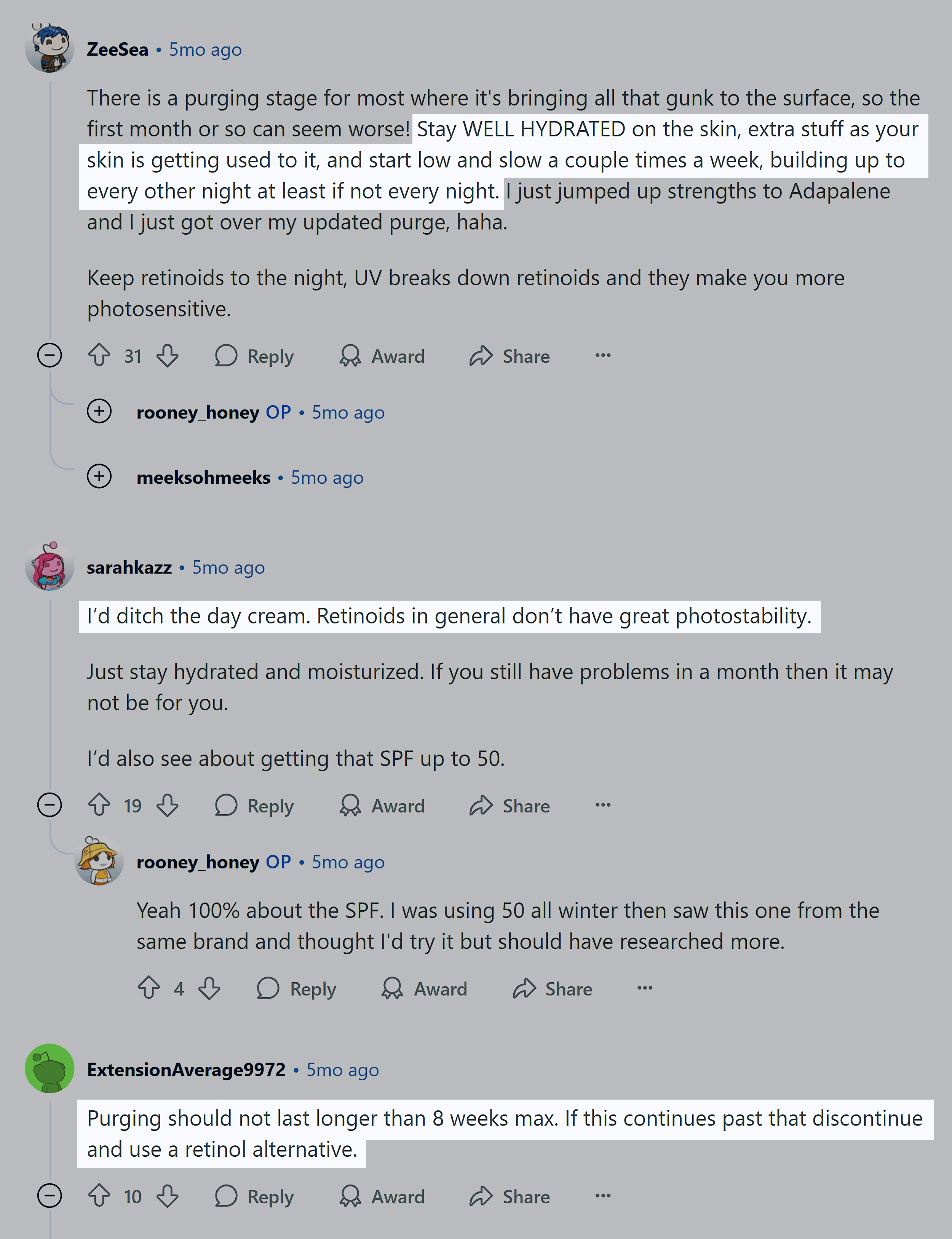

Here’s a post where the original poster (OP) shares their concerns about using Retinol, an ingredient known for its anti-aging properties.

Other Redditors share their take and advice on this issue, highlighting some alternatives to consider.

For a skincare brand, this post is helpful to understand:

- Buyers’ concerns regarding Retinol

- Commonly used and recommended solutions

Based on these insights, the brand can create content focusing on the best practices for Retinol use. Another great idea is to make a beginners’ guide for using Retinol and taking care of your skin.

Besides, Reddit also offers something other platforms can’t: clear signals of what not to do.

Upvotes highlight ideas and opinions people love. Downvotes show the perspectives or advice they reject.

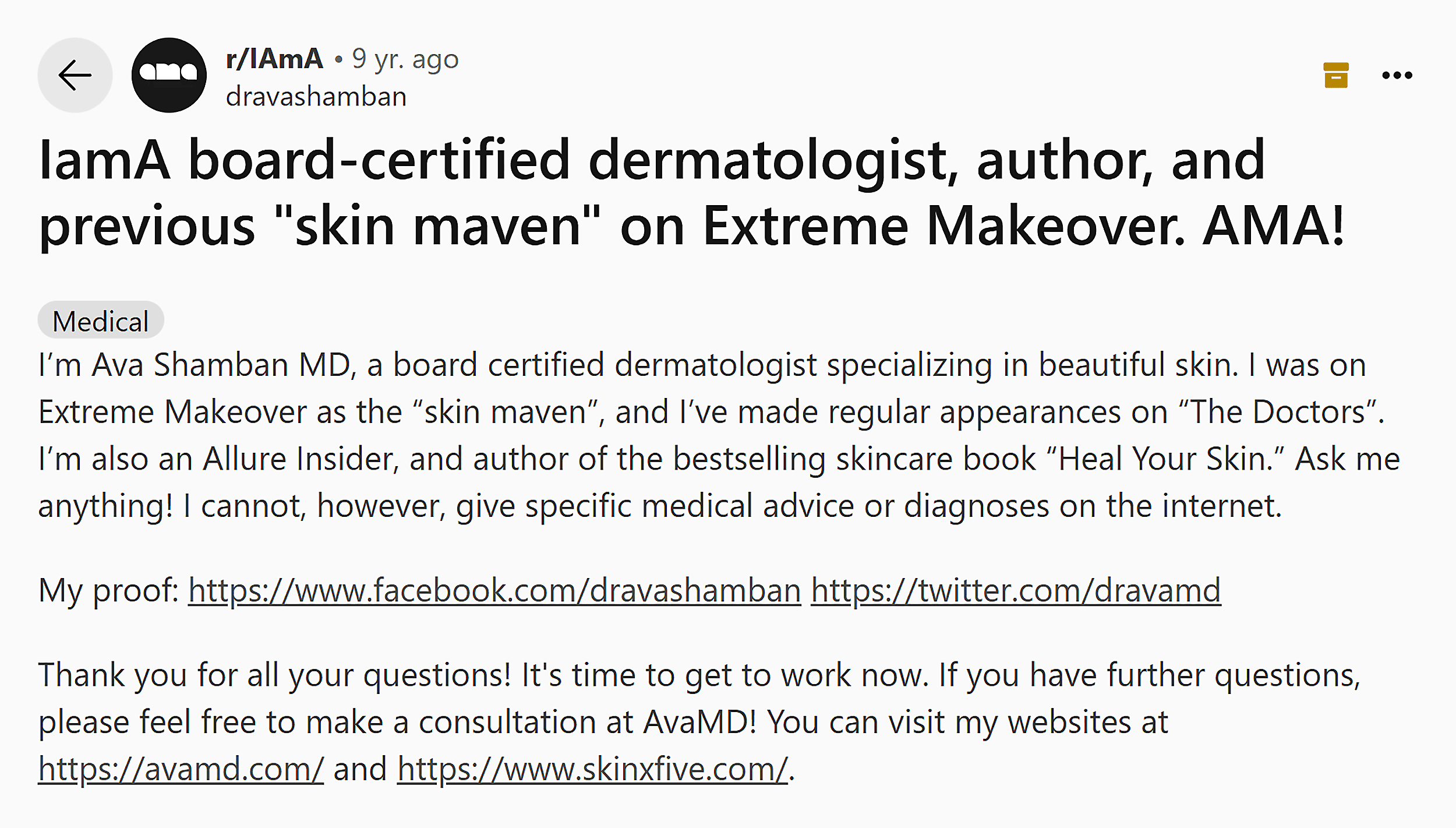

Find AMAs (Ask Me Anything)

Ask Me Anything (AMAs) can be a gateway to your audience’s biggest questions or issues they’re curious about.

Any industry expert or influencer with trusted credentials can host an AMA.

Here’s an example from a certified dermatologist.

Questions asked in this thread reveal issues where people need an expert’s guidance.

For example, one Redditor asked for basic skincare regimens while another shared a question about stretch marks.

Pay attention to questions with high upvotes. Those are the ones that most people want advice on.

Check Out YouTube Comments and Videos

YouTube is the second-largest search engine where people go to solve problems, compare options, and learn new skills.

Naturally, it can reveal a lot about your buyers.

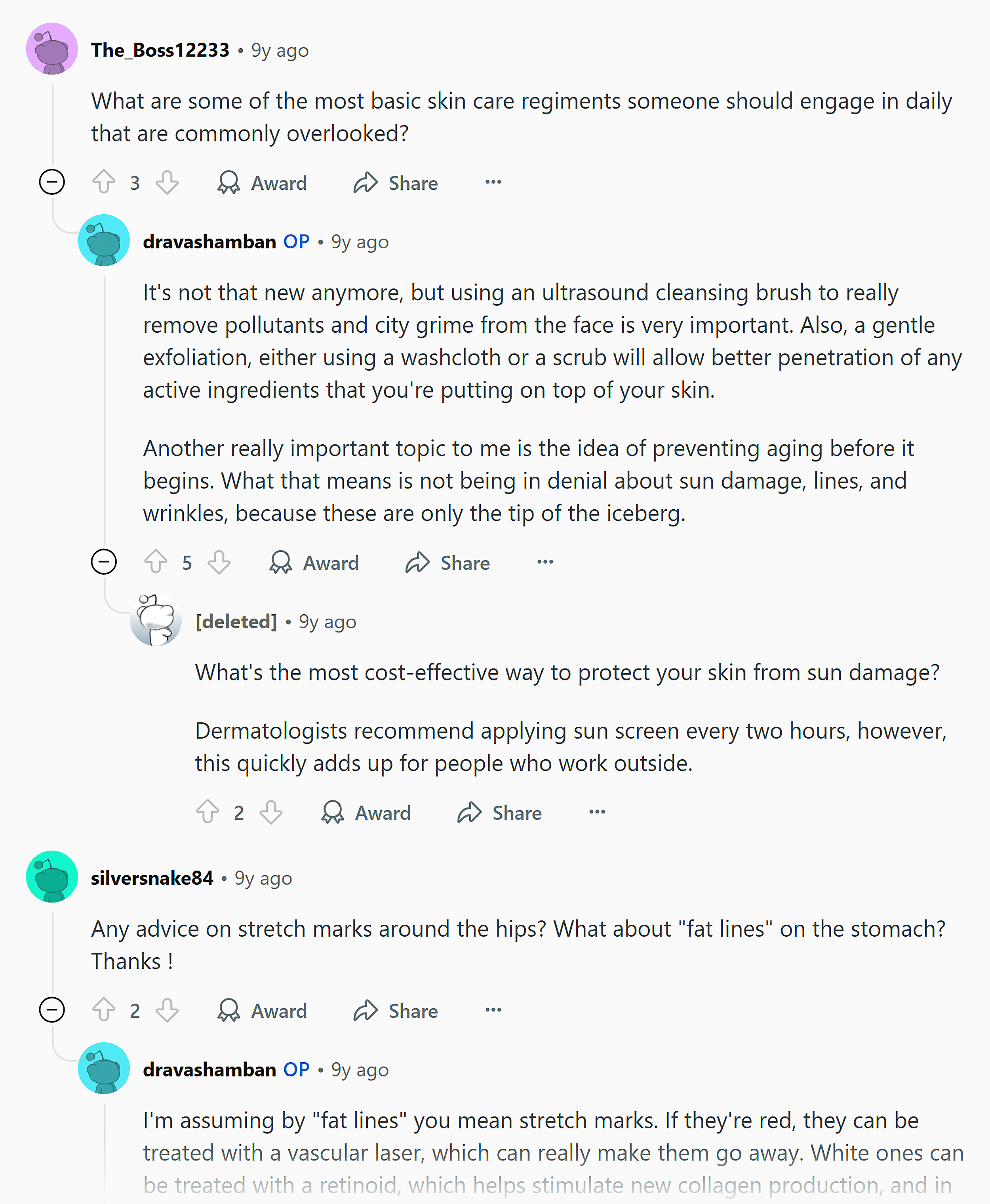

An audience intelligence tool like Sparktoro is a good starting point for YouTube research.

When you enter any keyword, it lists the most relevant YouTube channels for this audience.

Visit these channels and extract rich insights based on the steps I explain below.

Analyze Comments Using LLM Tools

A YouTube video gives you one perspective.

The comments give you hundreds.

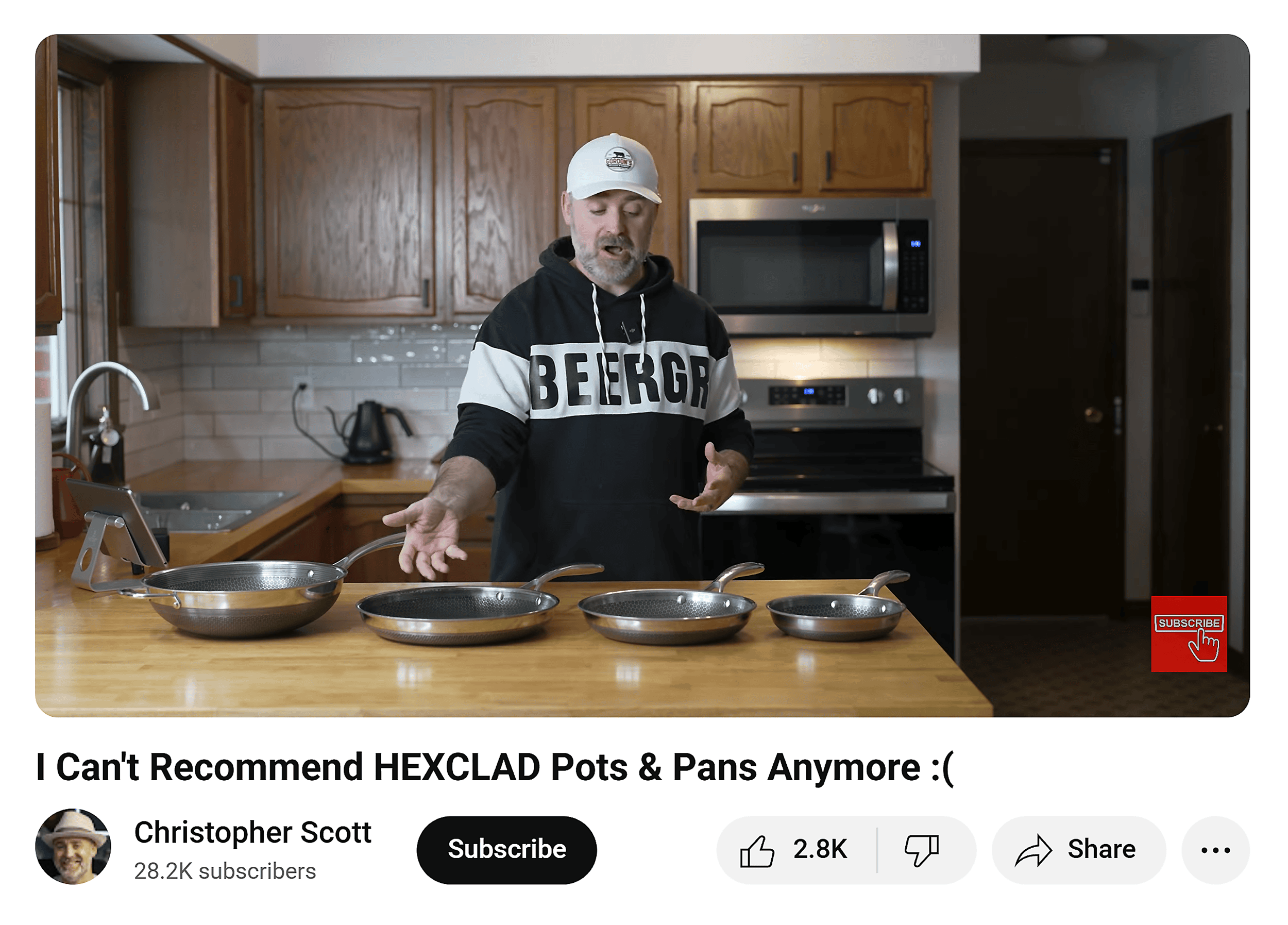

For example, this video comparing stainless steel pans with cast iron skillets tells you the creator’s subjective take on the topic.

But when you scroll through the comments, you’ll find which option people prefer — and why.

Here’s a quick and easy process to document insights from as many YouTube videos as you want.

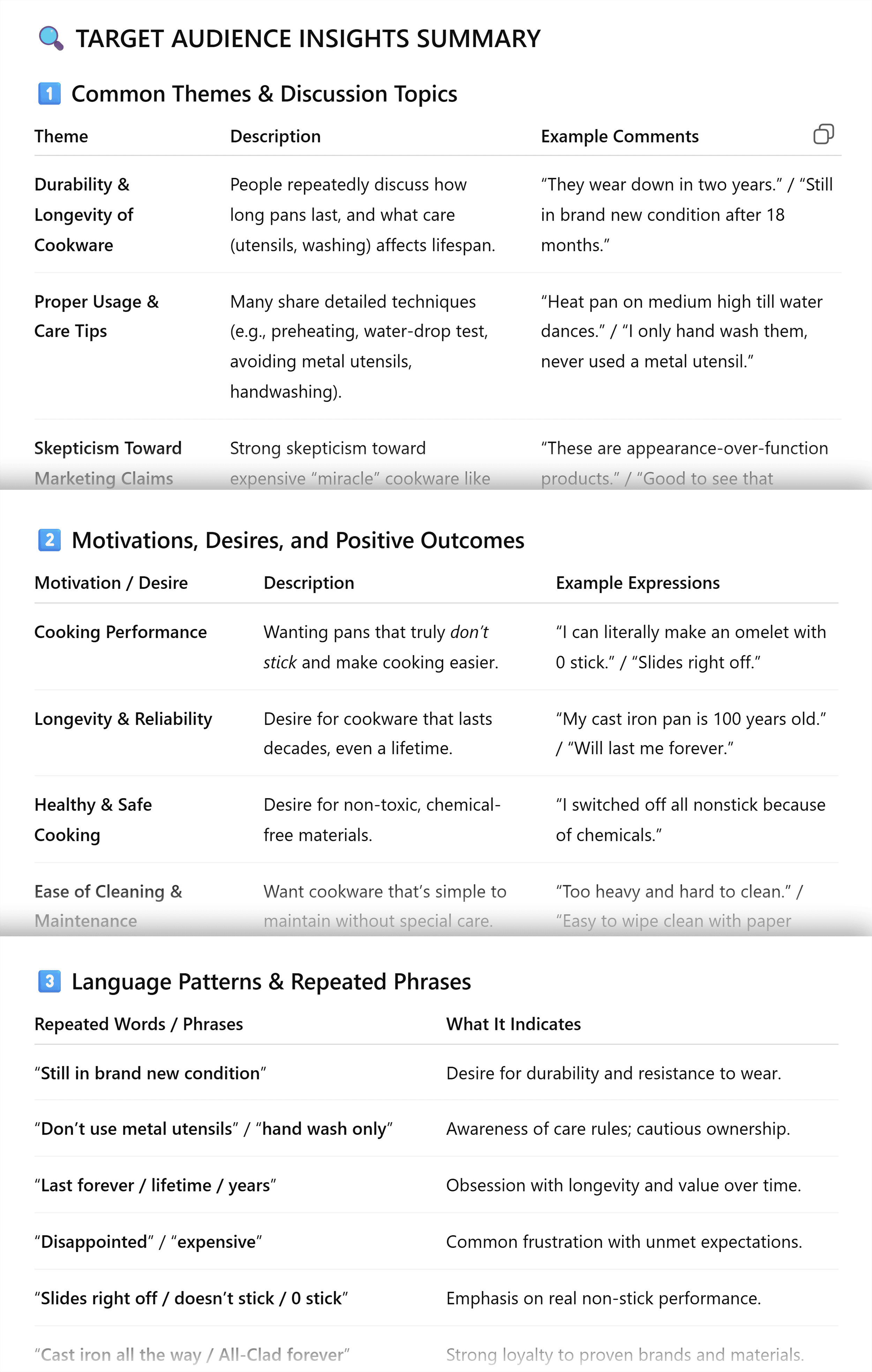

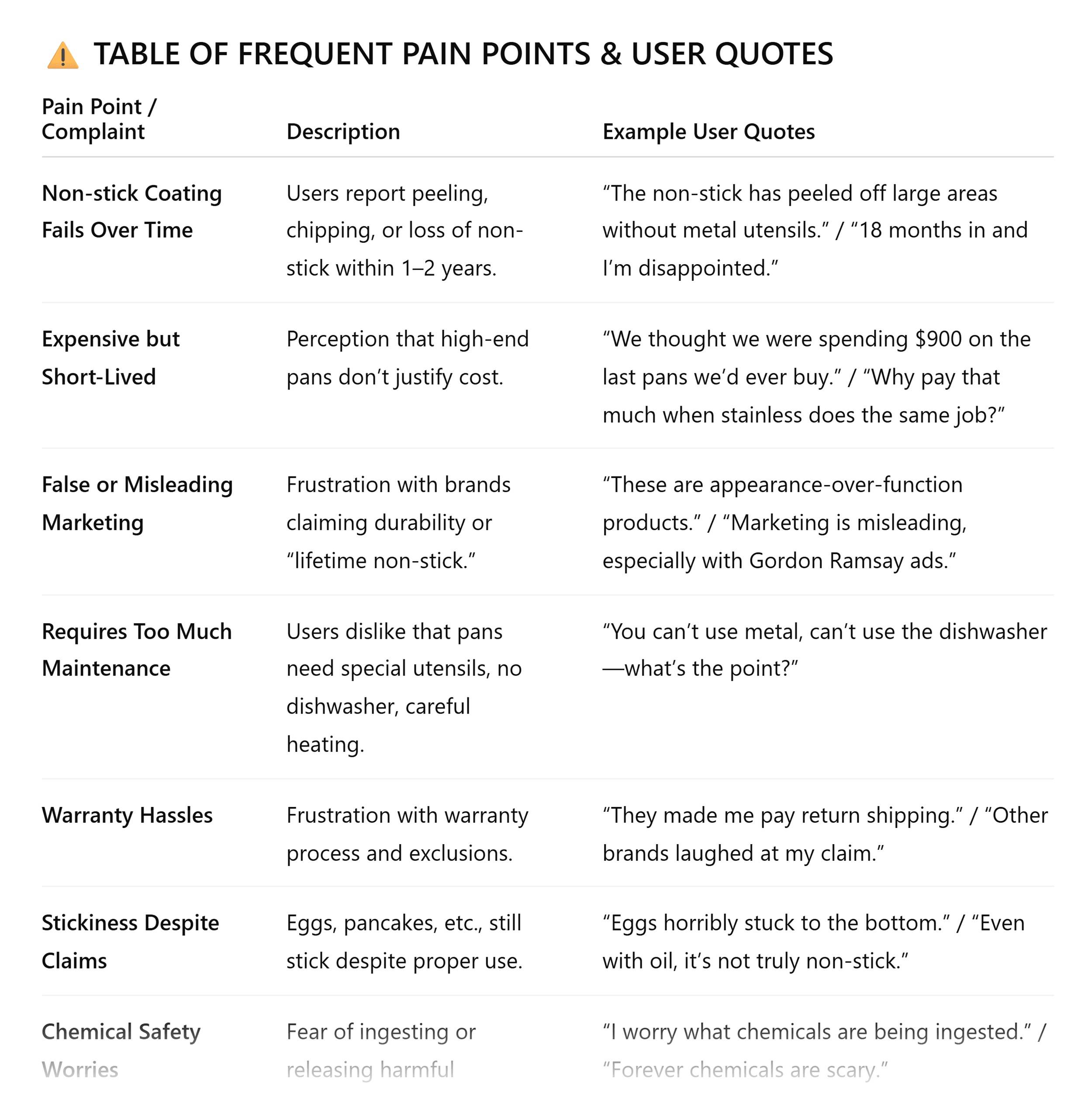

Copy comments from every video in one go. Then, paste them into ChatGPT or any LLM tool of your choice.

Share this prompt to extract common pain points and themes:

I have added a collection of YouTube comments below. Please analyze them as if you’re conducting target audience research.

Identify:

→ The most common themes and topics people talk about

→ Motivations, desires, or positive outcomes they want

→ Patterns in language (words/phrases that repeat often)

Present your findings in a structured summary. Create a table highlighting frequent pain points, frustrations, or complaints, and add users’ quotes for each pain point.

Here are the comments:

[Paste comments]

This way, you can turn hundreds of scattered thoughts into a structured list of what your audience actually struggles with in their exact words.

I tried this myself and here’s how it went:

I found a clear breakdown of my audience’s pain points spelled out in their exact words.

Add these to our research tracker — and just like that, I have topics for my next few Instagram reels, like “Health concerns around non-stick pans” and “Why stainless steel pans are better than non-stick.”

Learn From User-Generated Content

Beyond comments, user-generated content (UGC) can also offer a direct line into what your buyers care about.

Think product reviews, unboxing videos, comparisons, or even vlogs where people share how they use a product.

Notice the kind of pros and cons that people highlight in these videos.

For example, this YouTube creator made a video about his decision to stop using Hexclad pans.

He explains:

- Why he bought these pans

- What went wrong with these products

- What alternatives he considered and switched to

Use these insights to understand key buying factors and some pain points worth exploring.

Explore Social Media Platforms Your Buyers Use

Social media works best as an audience research method when you know where your buyers actually spend their time.

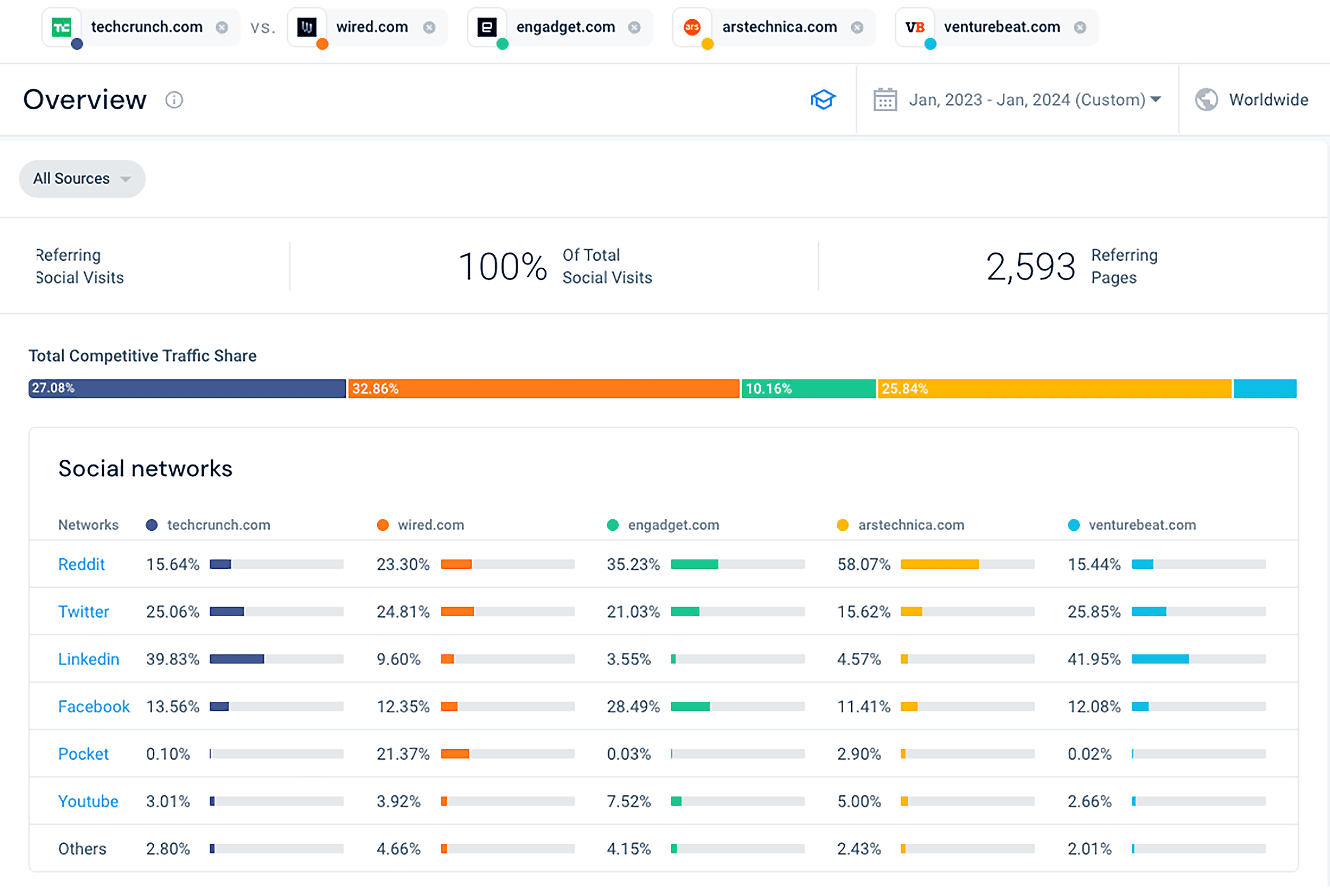

Tools like Similarweb make this easier by showing you which channels your audience prefers.

Add your website and a few key competitors to get started, like this example with TechCrunch, Wired, and other competitors.

Here’s how the tool breaks down each brand’s audience share on different social media platforms:

The takeaway: Identify the platforms that matter most to your buyers and dig deep into those spaces.

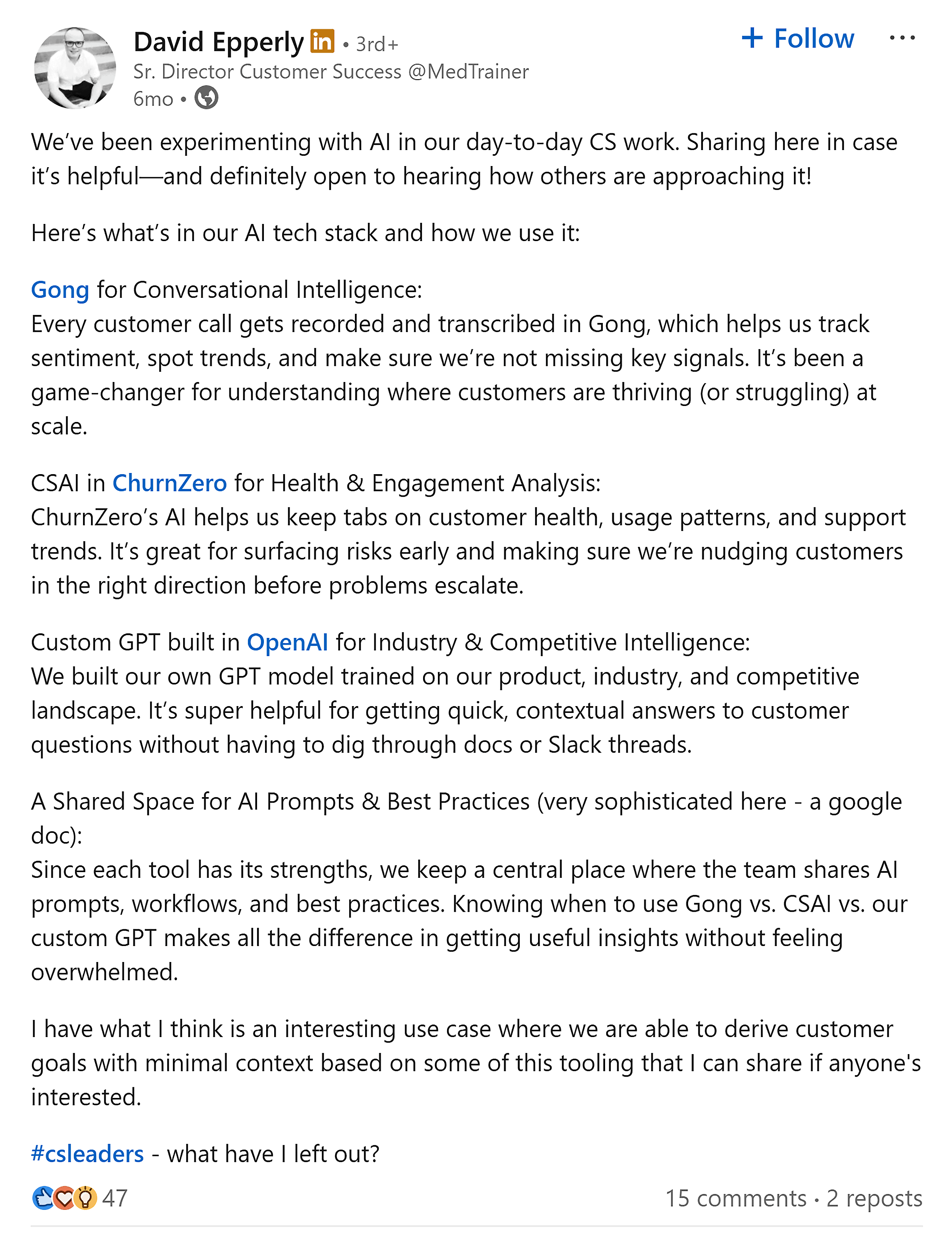

On LinkedIn, start by identifying people who fit your Ideal Customer Profile (ICP).

Pay close attention to the posts they share — their wins, failures, roadblocks, and processes.

These real-world updates reveal where your product or service can make a meaningful impact.

For example, if your ICP includes customer success teams, this LinkedIn post shows how leaders are experimenting with AI tools.

It highlights both opportunities and gaps you could address — like growing interest in a trend (opportunity) or frequent complaints (gap).

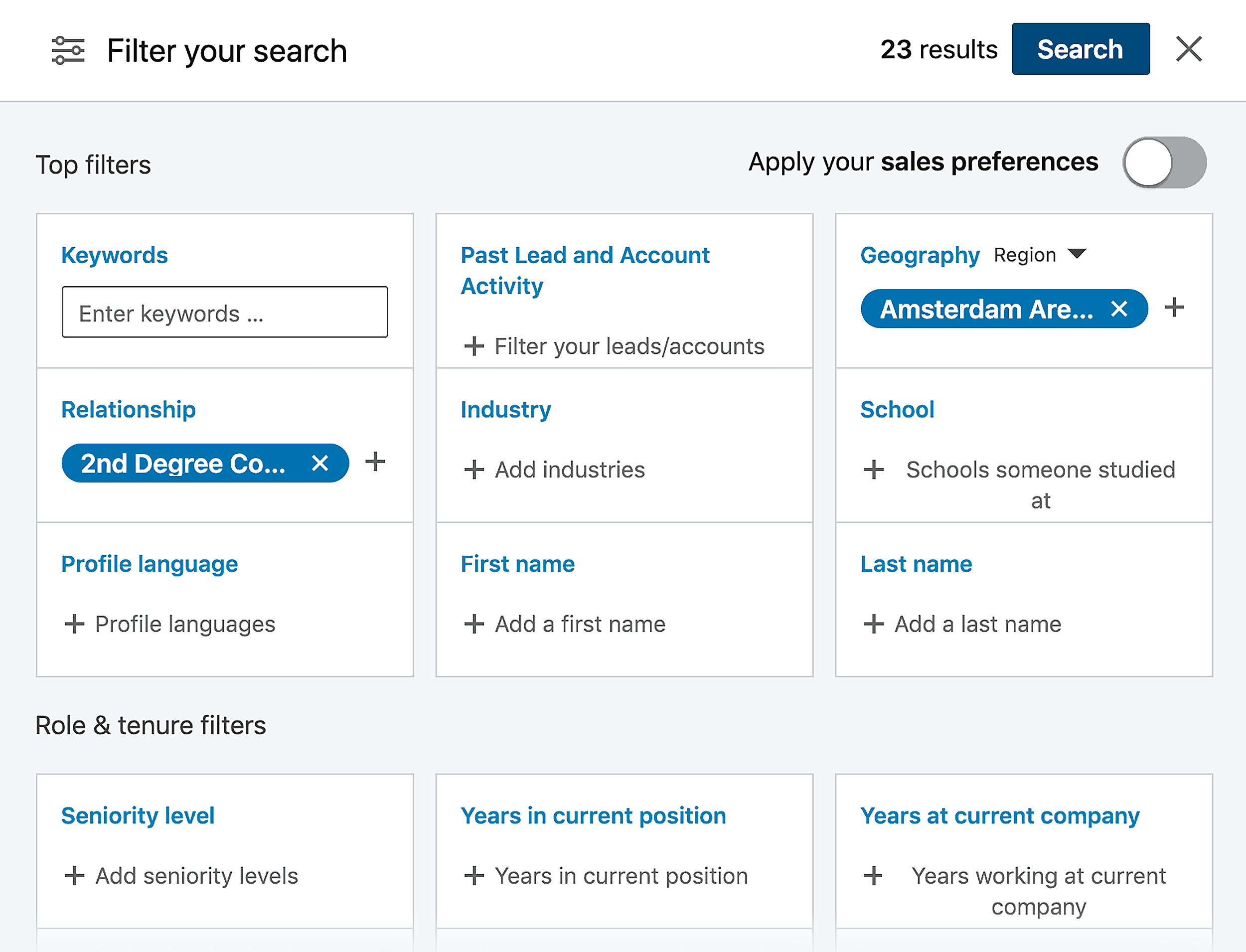

To scale your research, use LinkedIn Sales Navigator to apply filters and zero in on the right people within your ICP.

For example, you can filter results by industry, keywords, location, seniority, language, and more of these filters.

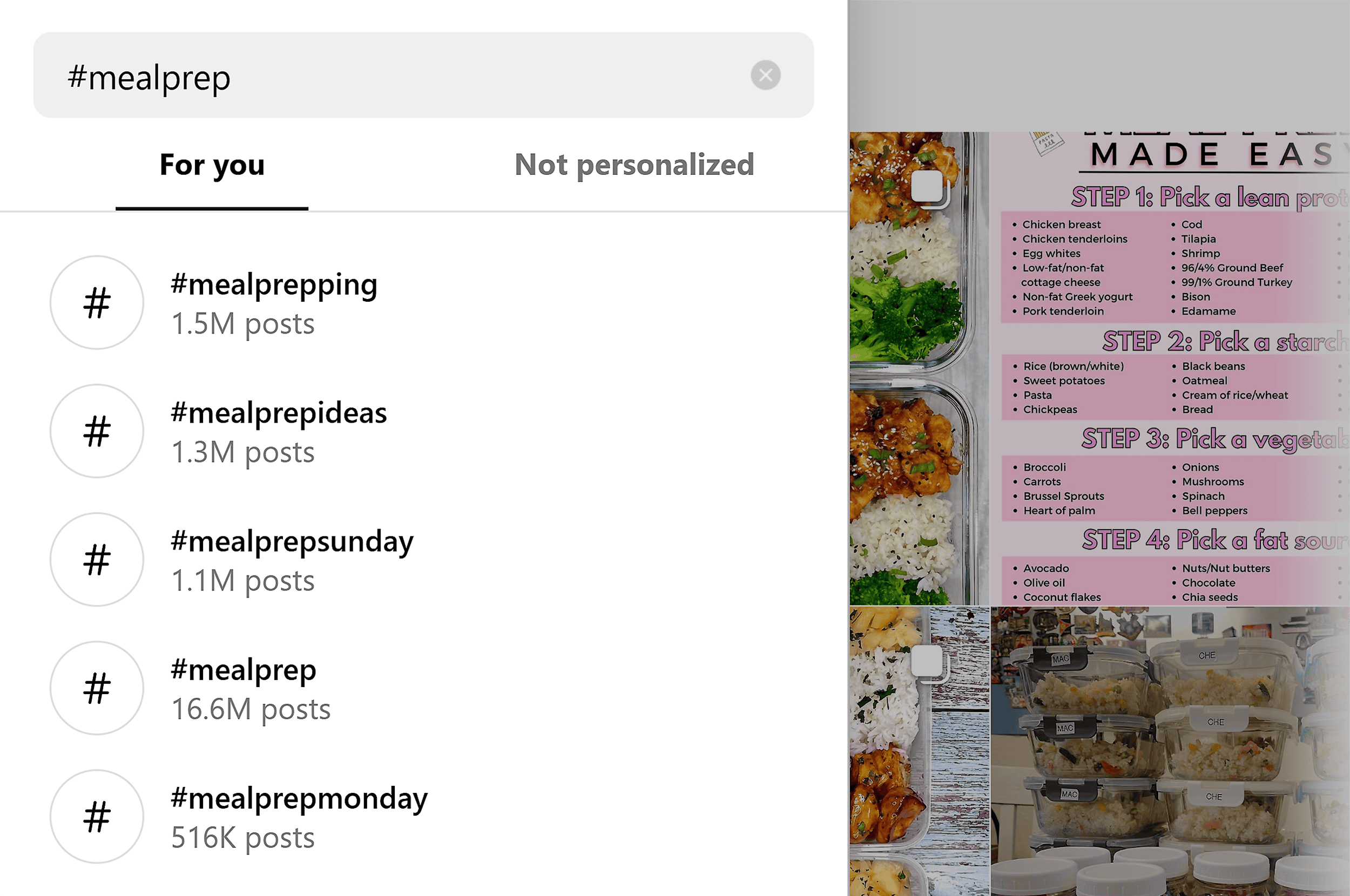

Instagram hashtags are a great way to discover audience interests.

Start with broad themes like #mealprepideas to see what’s trending.

Each hashtag (like a keyword) surfaces a collection of posts tagged with this term.

Look for posts with high engagement because they signal what truly resonates.

For instance, this post earned over 393k likes because it offered clear, visual recipe ideas that people found useful.

Like LinkedIn, you can also follow influencers or niche creators in your space to get closer to your audience.

Their posts (and especially the comments) often pinpoint the questions, frustrations, and goals your buyers are struggling with.

TikTok

To use TikTok as an audience research method, create a fresh account dedicated to your niche.

Interact only with videos specific to your space, and TikTok’s algorithm will start curating a feed of trending content.

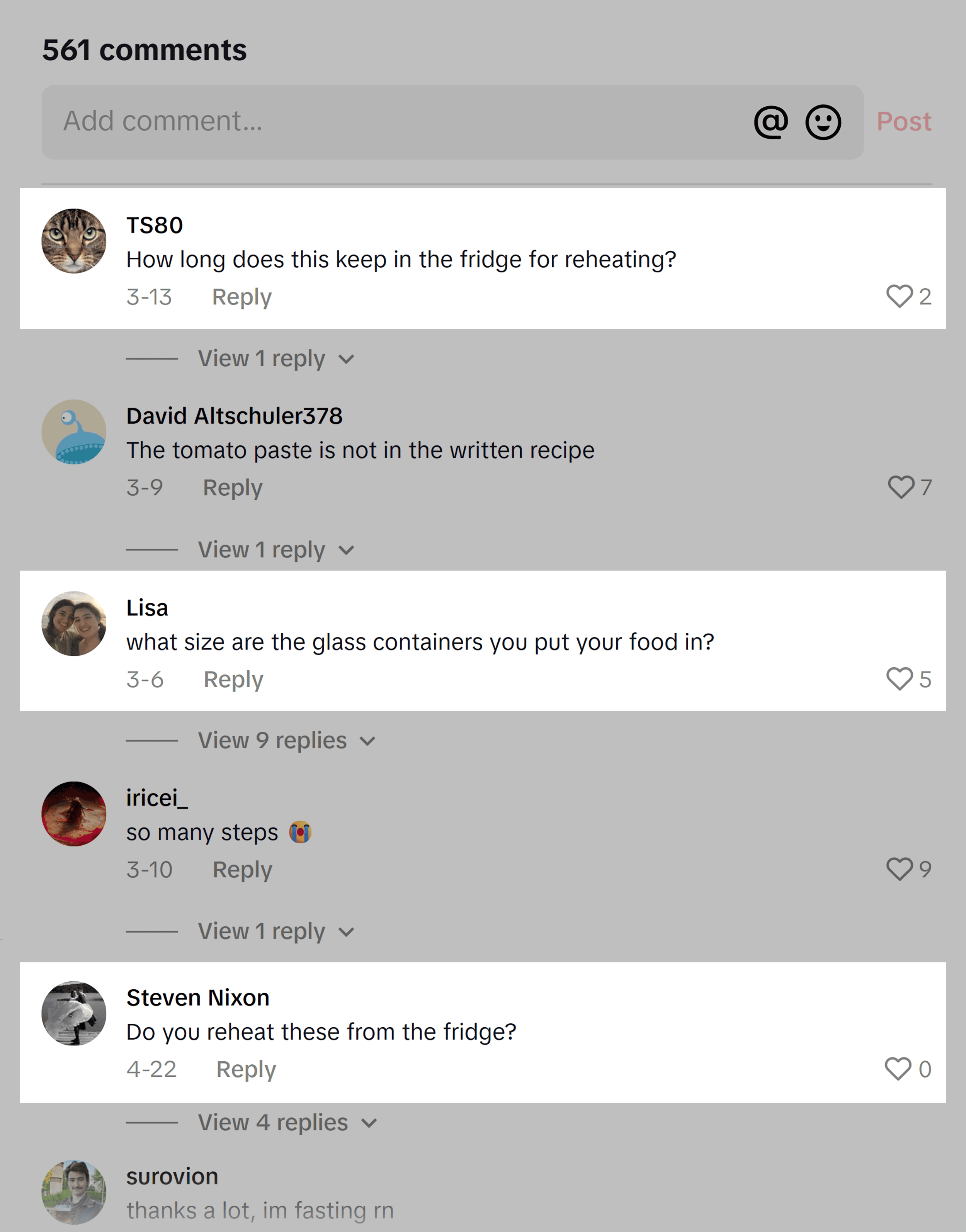

Once you see relevant videos, dive into the comments to spot recurring themes and pain points.

For example, the comments on this meal prep video include many questions about the containers and the recipe.

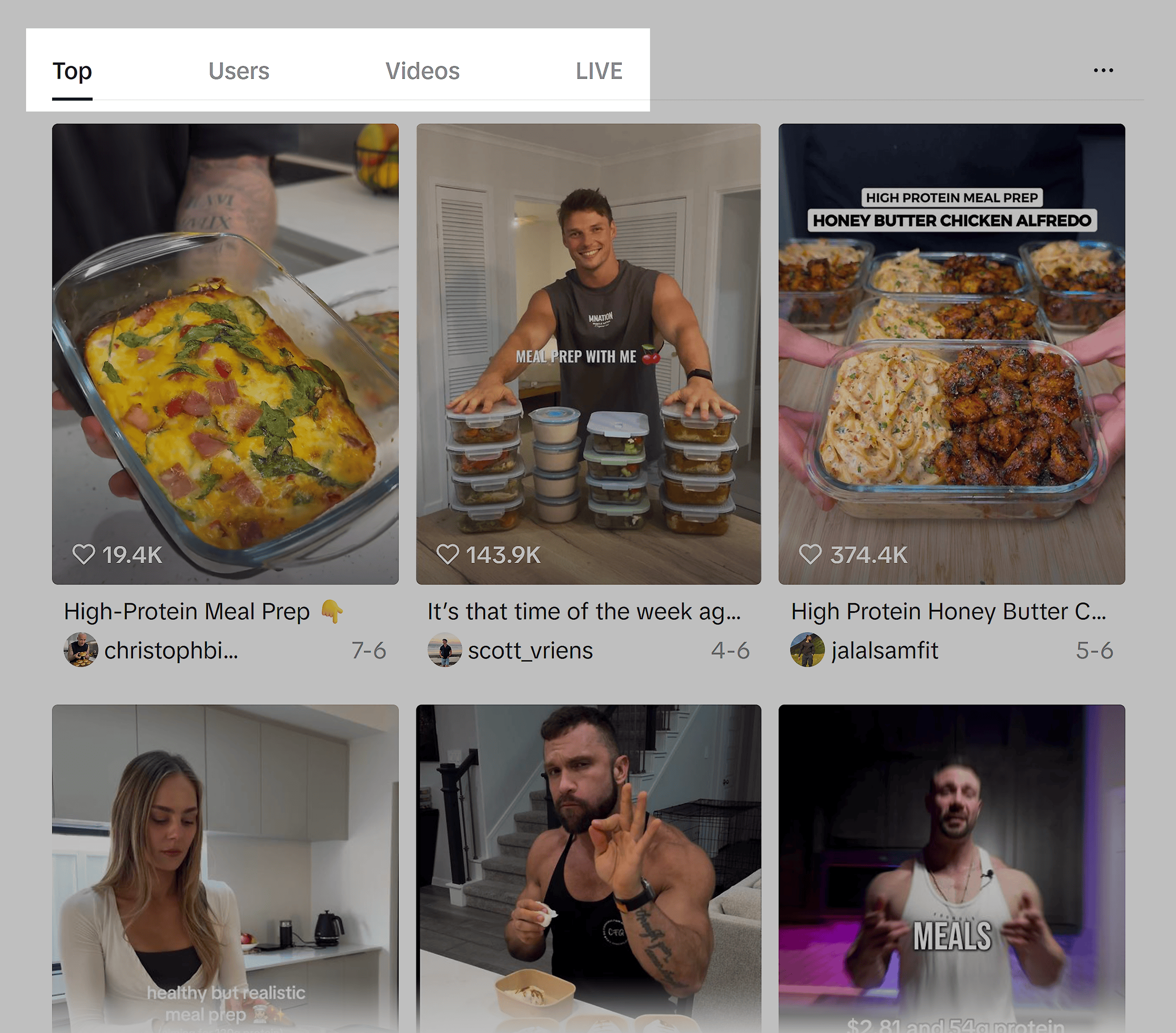

You can also search for your keywords and toggle between “Top,” “Users,” “Videos,” and “LIVE” content to explore different kinds of content on the app.

X

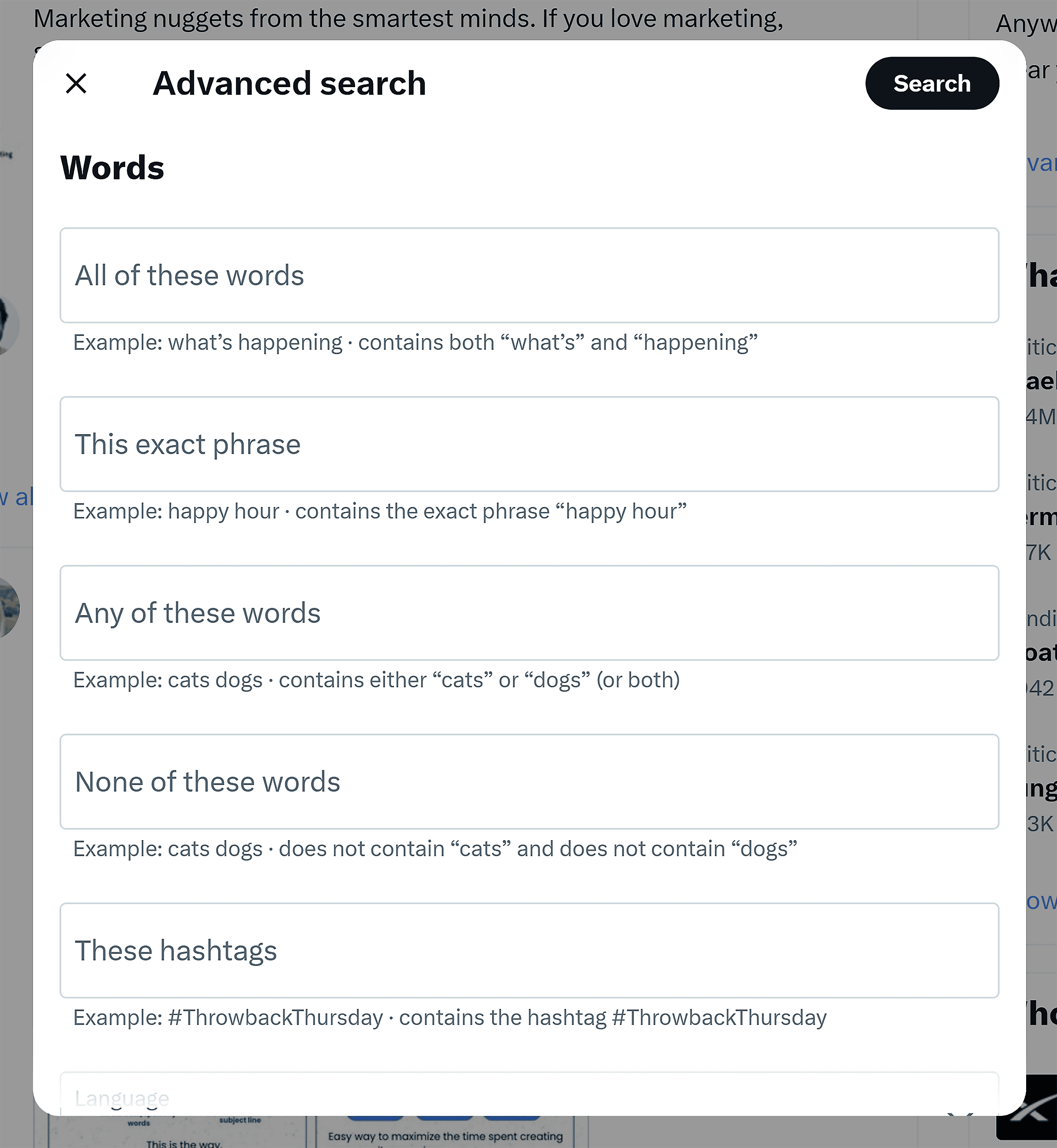

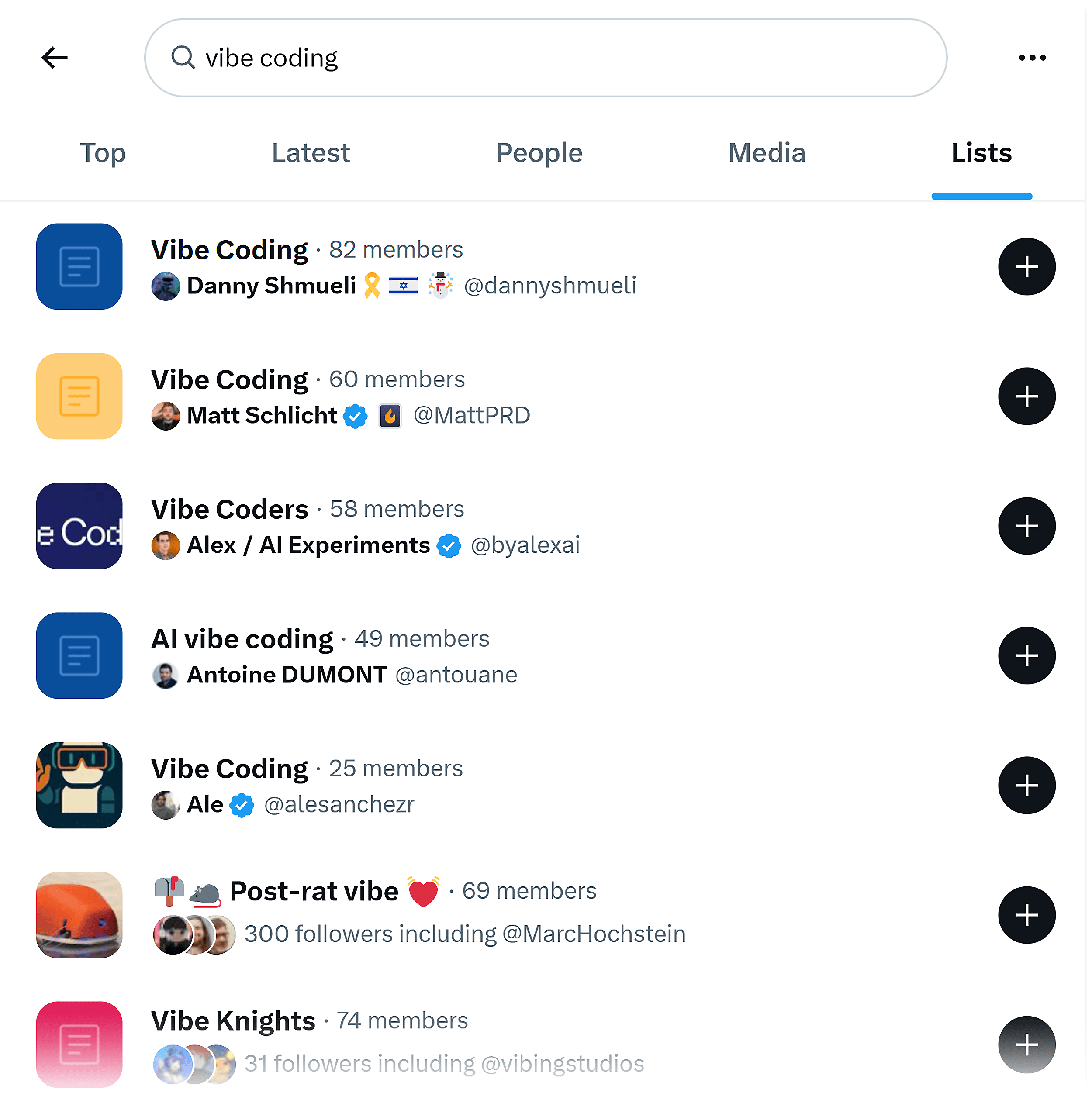

X has powerful tools for audience research if you know where to look.

Use the advanced search function to filter posts by keyword, engagement, account, or time frame.

Another underrated feature for target audience research: “Lists.”

It lets you build a curated feed of accounts you want to hear more from, like potential customers, influencers, or industry voices.

You can either follow existing lists or create a new one.

For instance, searching for “vibe coding” lists shows ready-made feeds you can tap into for insights.

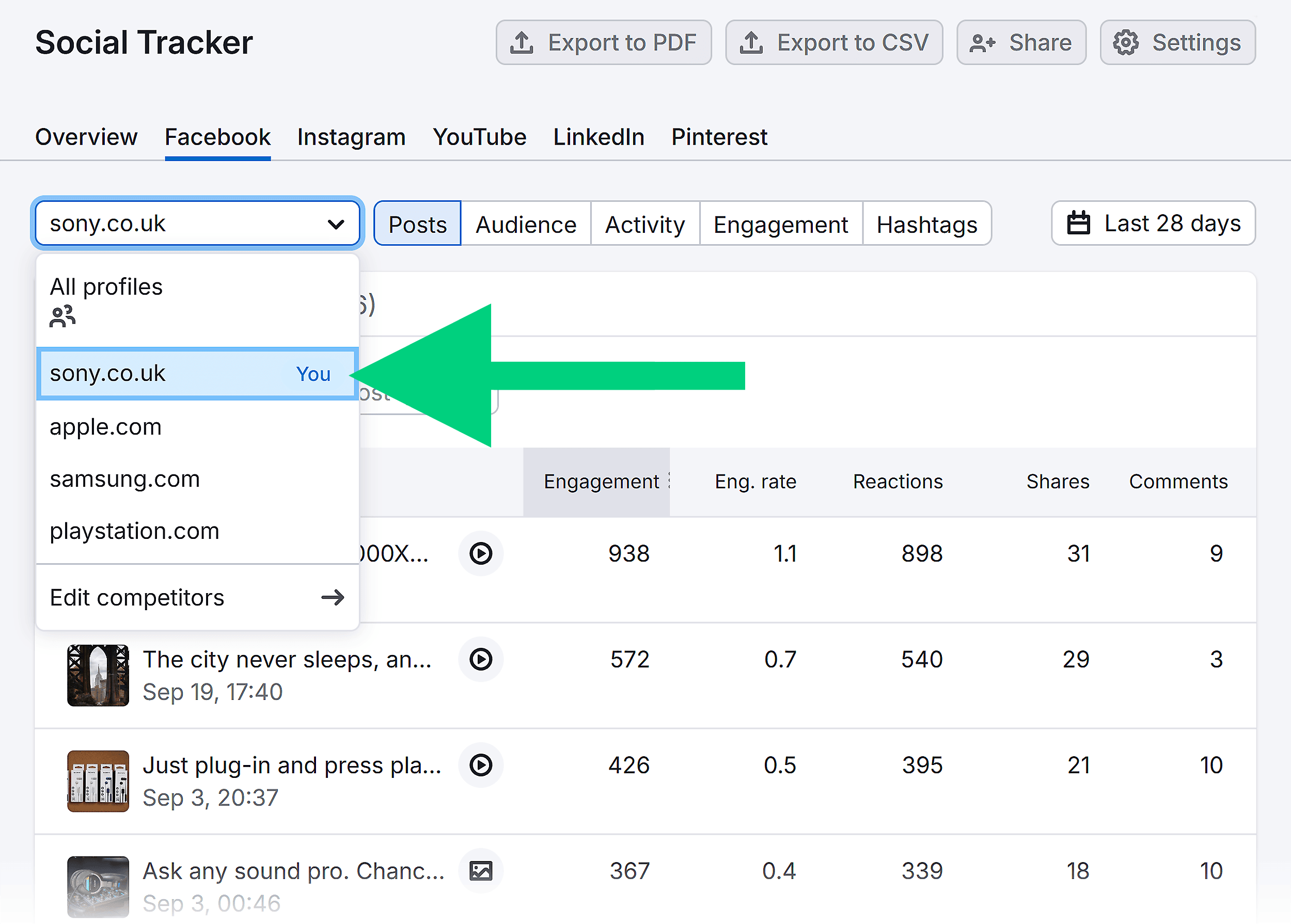

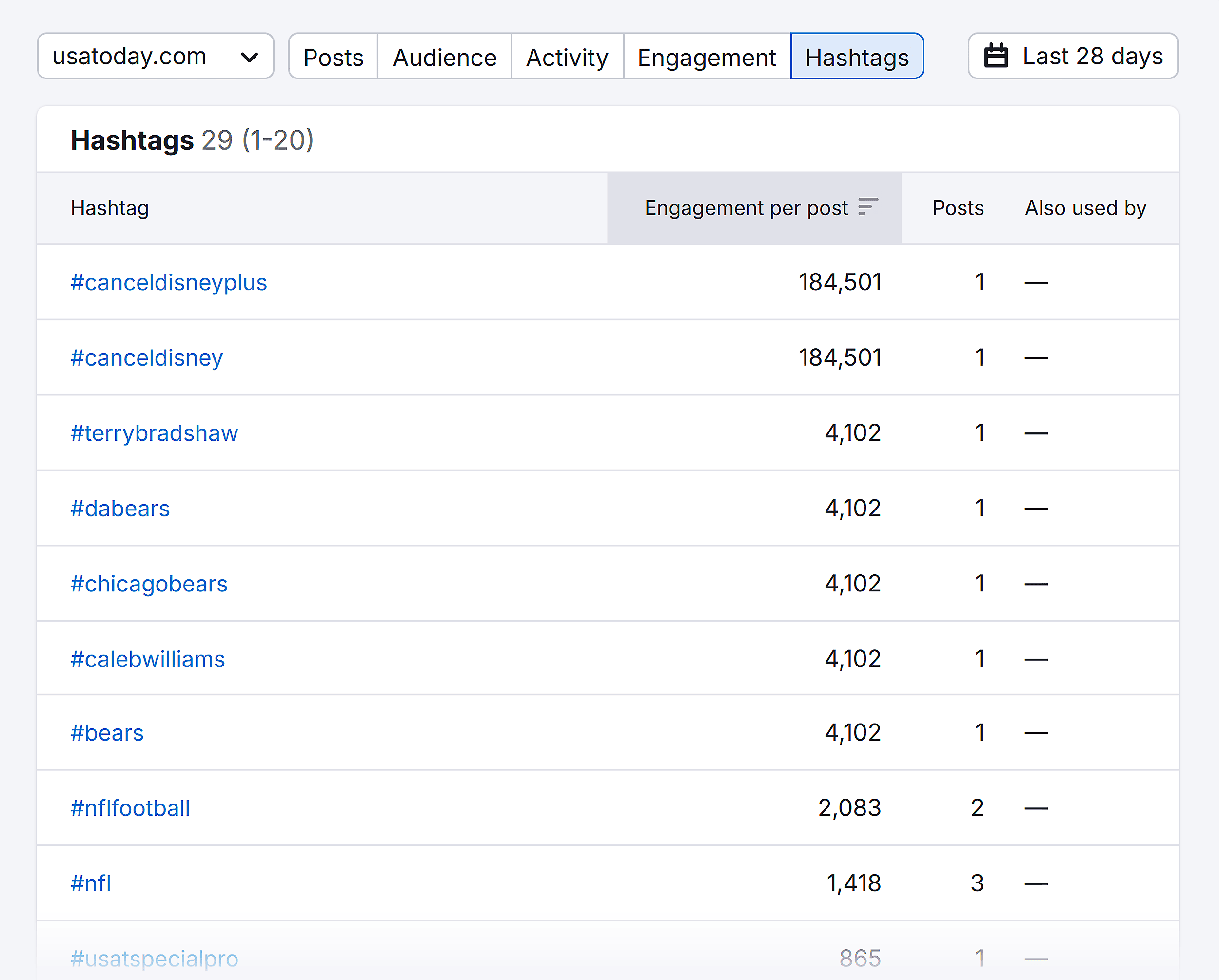

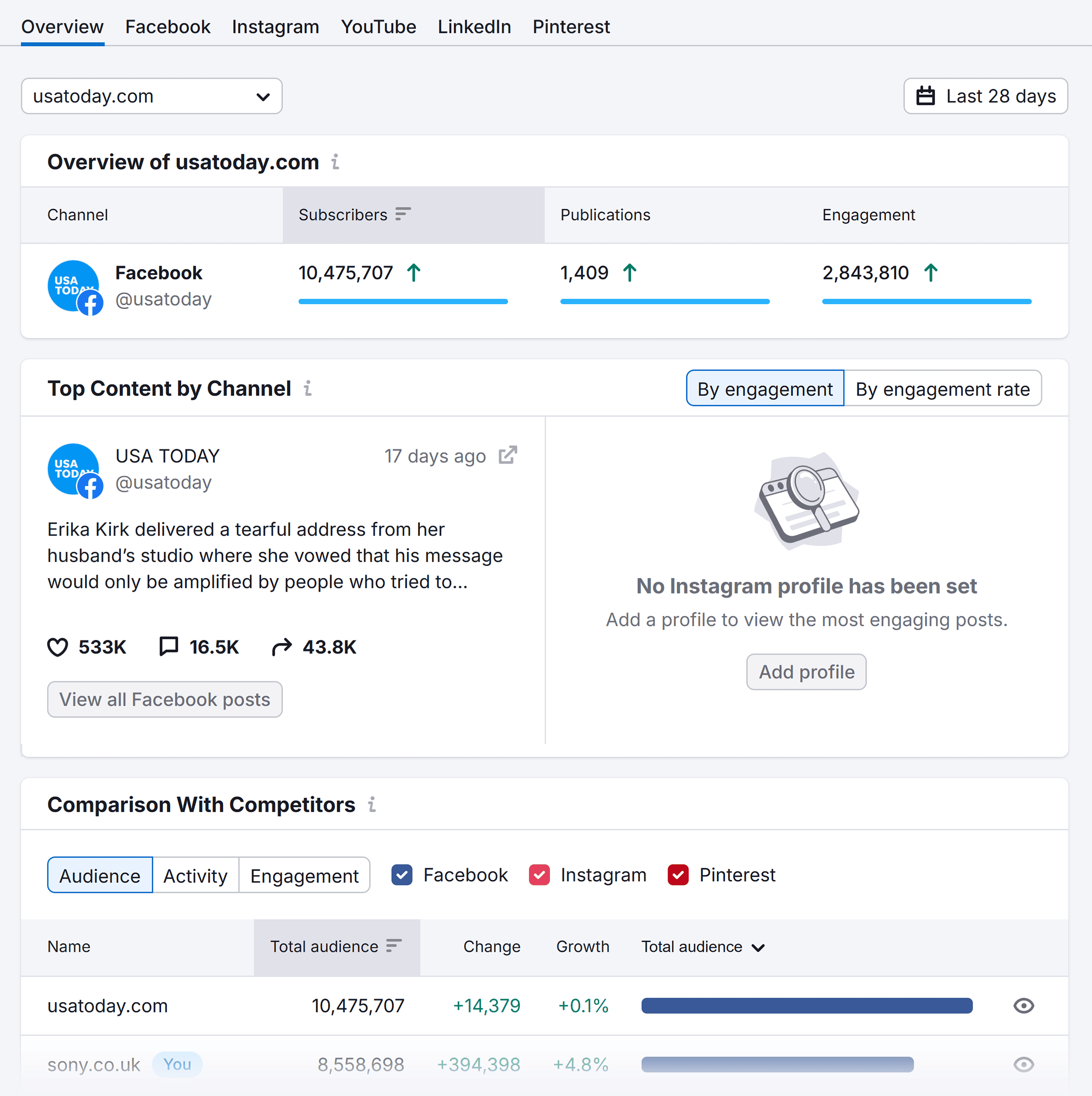

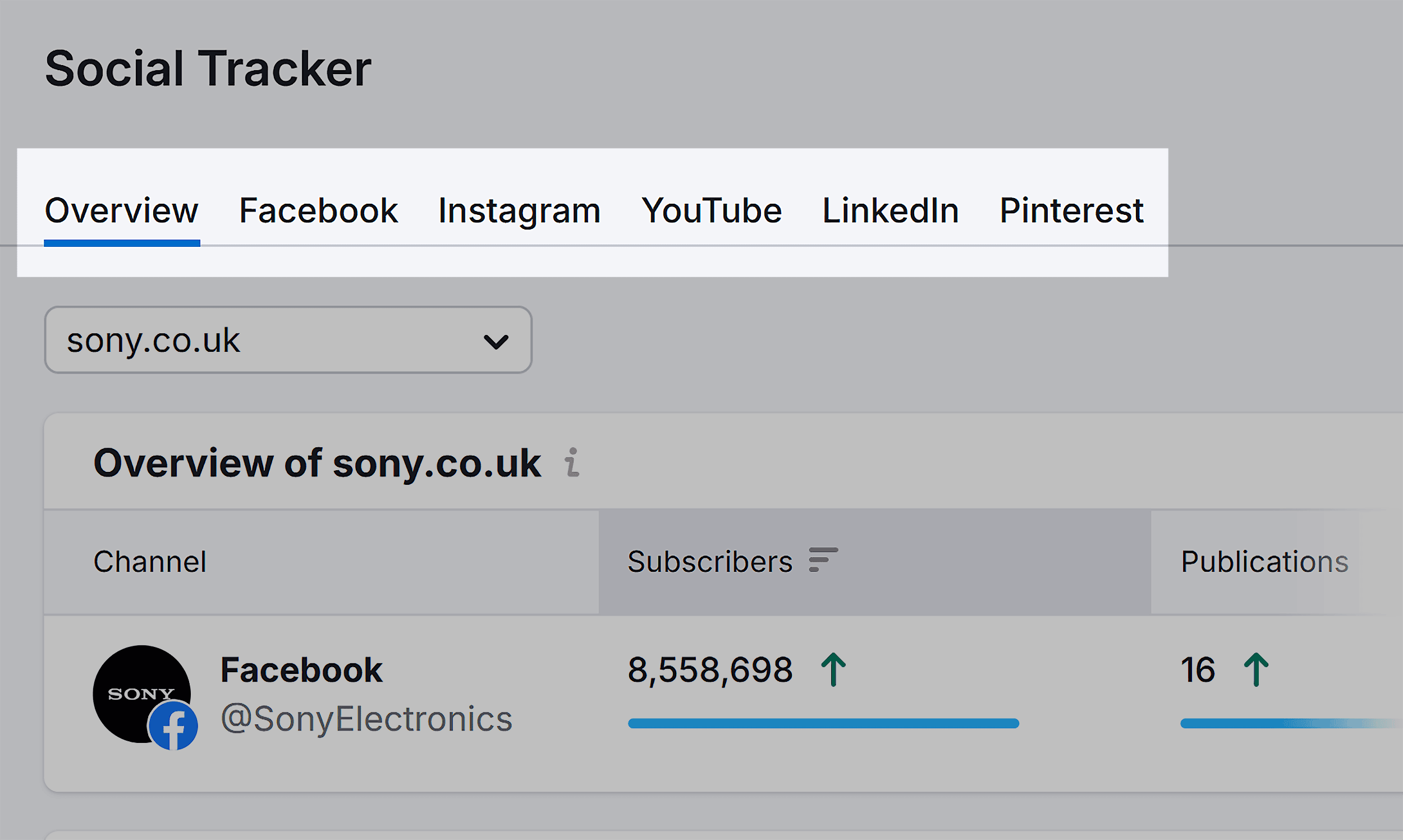

Compare Platforms with Semrush Social Tracker

Semrush’s Social Tracker helps you zoom out and learn more about your audience from multiple channels at once.

It pulls data from Instagram, Facebook, LinkedIn, X, YouTube, Pinterest, and TikTok, so you can see how your audience interacts with different channels.

With this report, you can identify which platforms generate the strongest engagement from your target audience.

And it’s easier to spot popular post formats (Reels, carousels, videos, etc.) and hashtags that drive interaction.

To get started, connect your social accounts and add competitor profiles in Social Tracker.

Use the “Overview” tab to compare follower growth, posting activity, and engagement side by side.

Then, jump to platform-specific tabs to get in-depth reports for each platform.

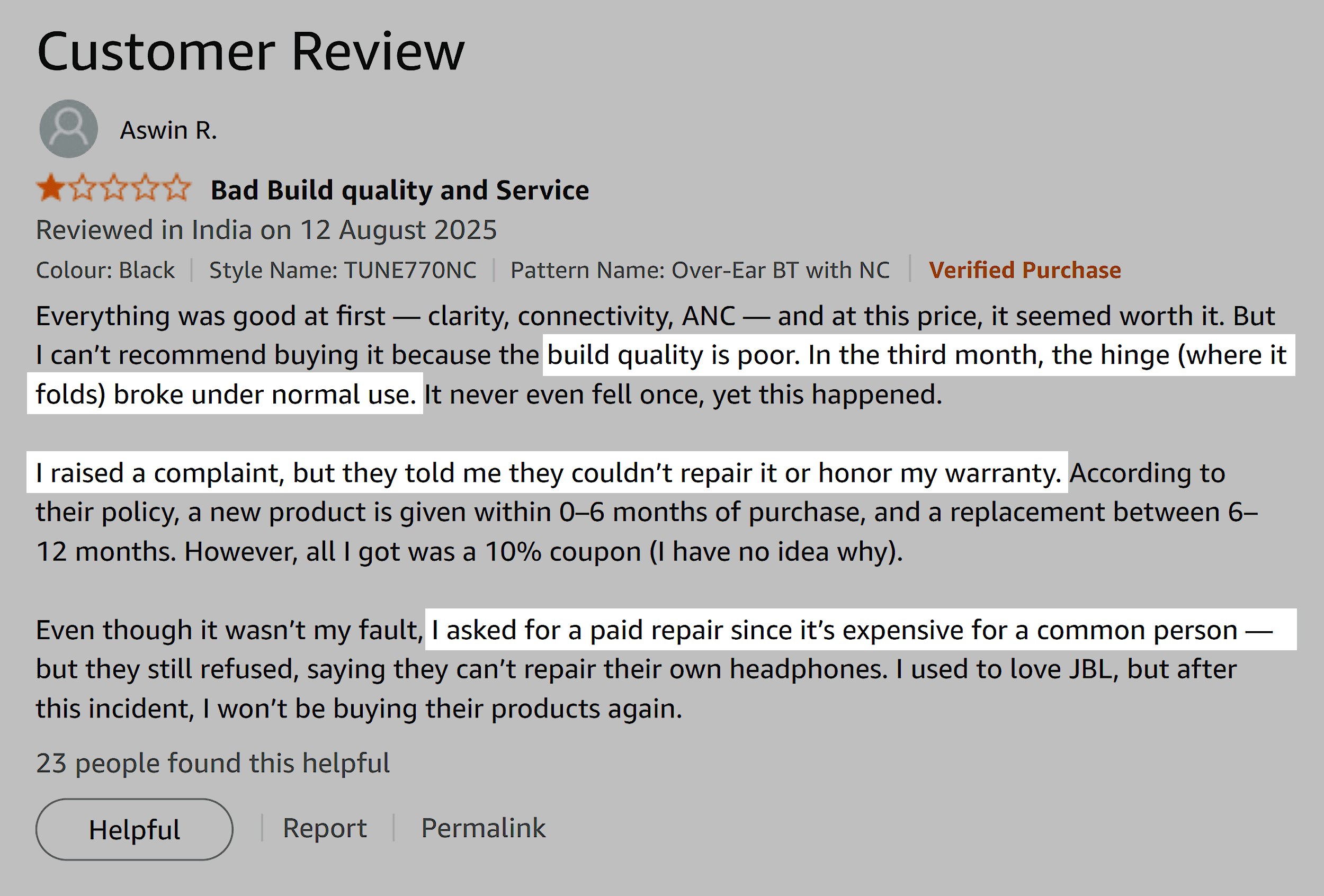

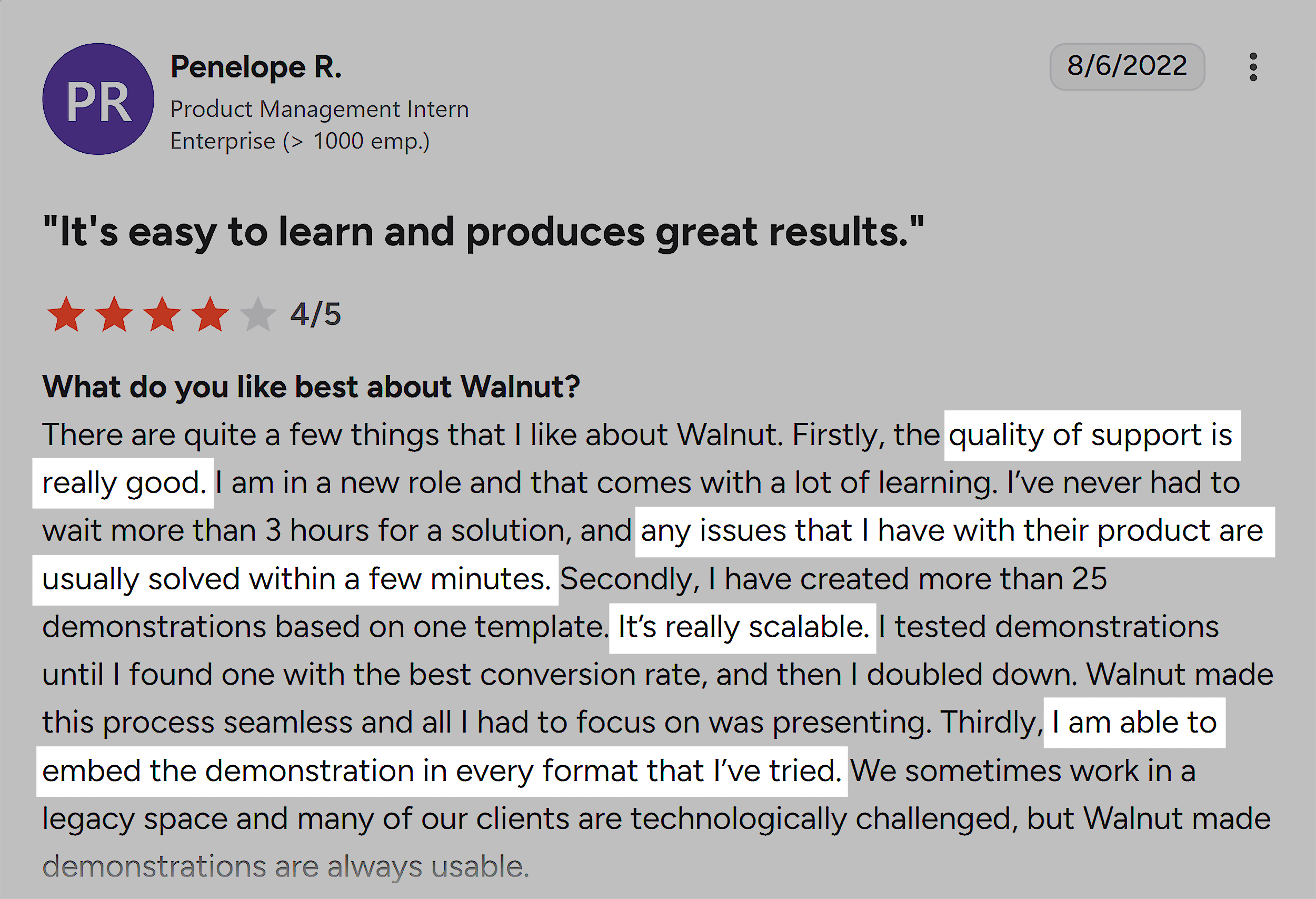

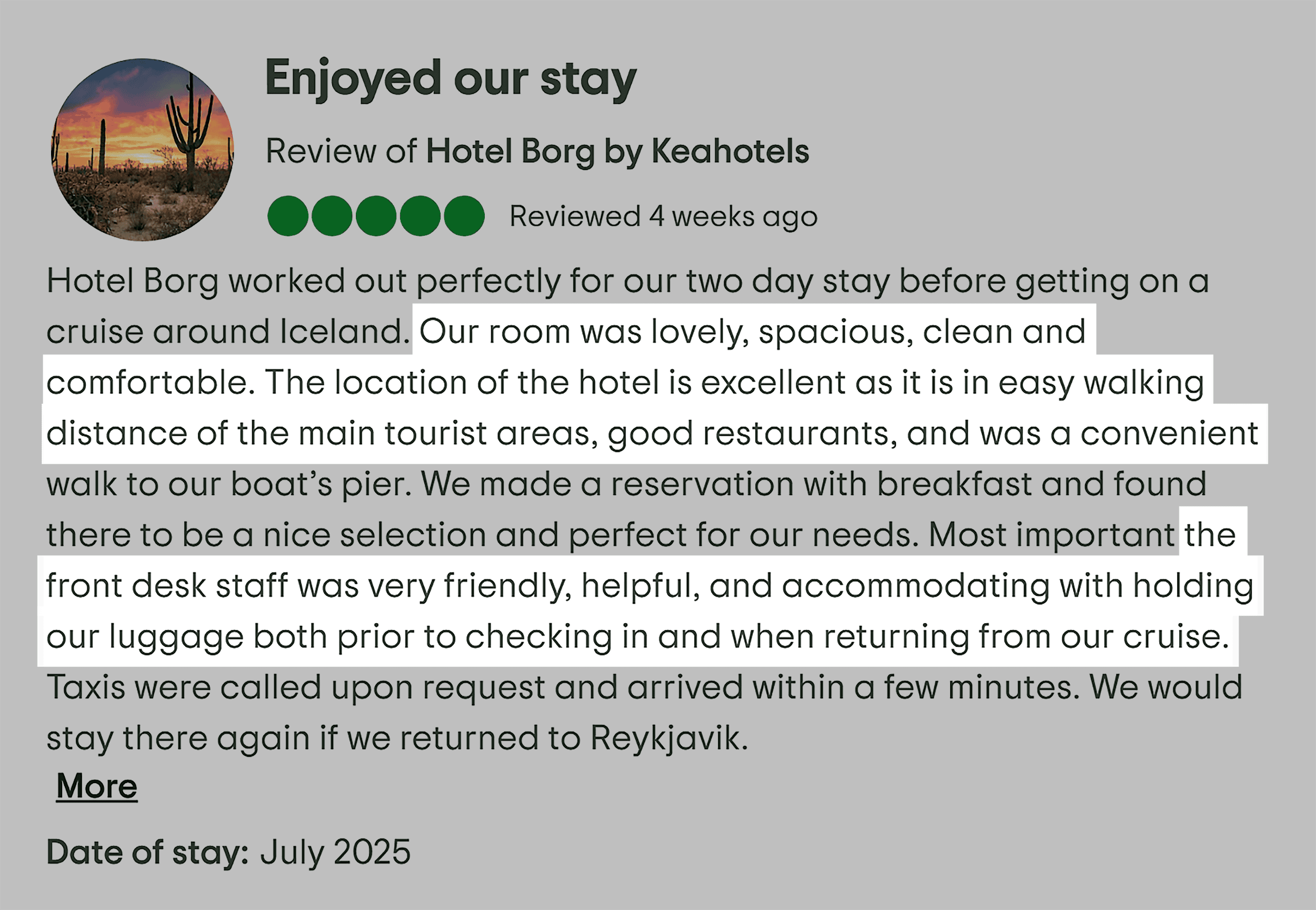

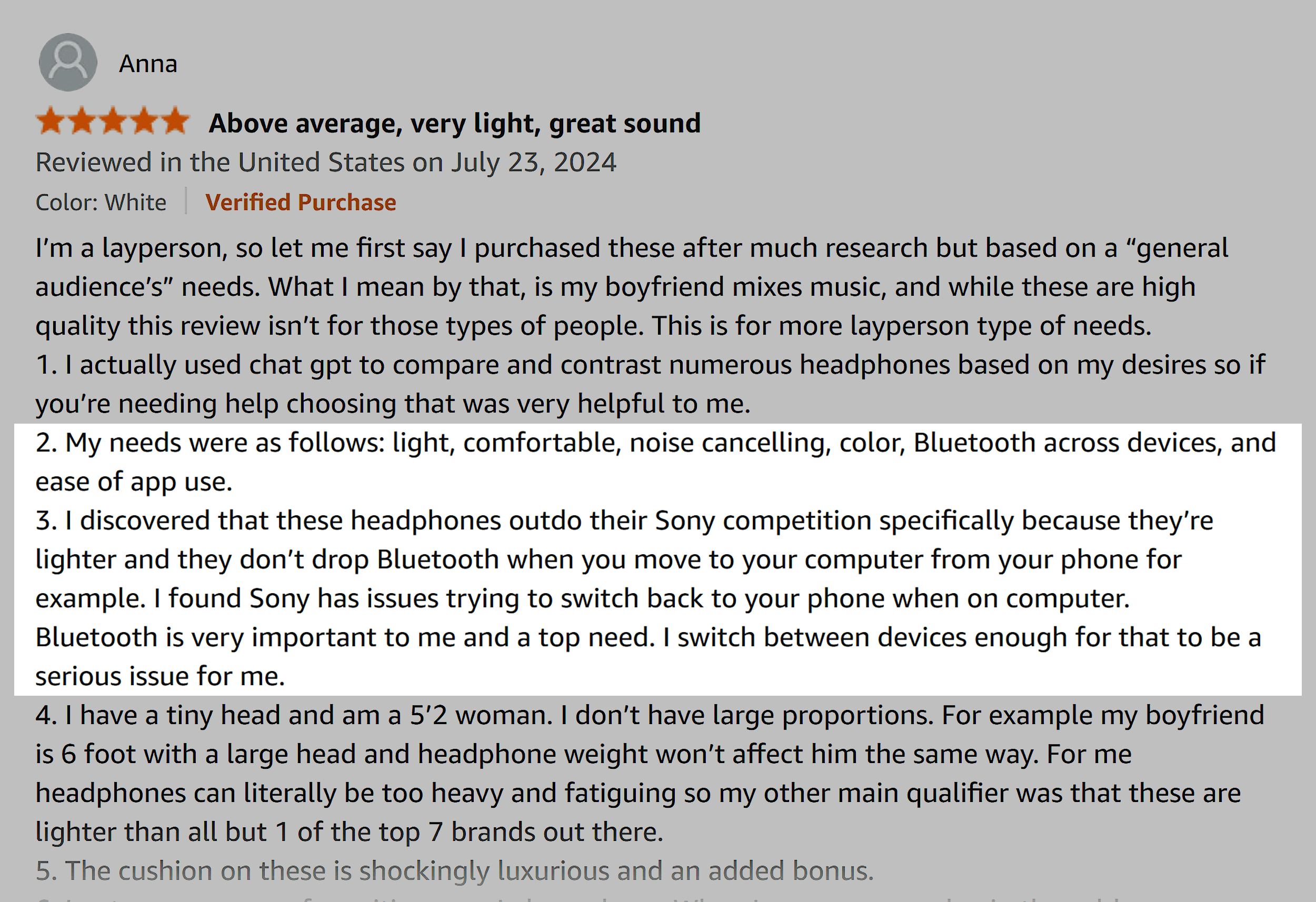

Mine Customer Reviews

A single customer review may just be one person’s opinion.

But when you analyze these reviews at scale, clear patterns start to emerge.

For starters, look for factors that led people to buy a product. Or, notice the cons people mention in low-rated reviews.

Both indicate pain points you can target.

For example, this customer calls out weak product durability and a disappointing warranty process.

You also want to find what success looks like for your potential customers. Is it saving time, cutting costs, improving quality, or something else?

Document the features they call out as good or bad.

This insight can shape your messaging and even suggest improvements for your offering.

See if reviews pinpoint any competitors that people considered. Note why they chose or didn’t choose a specific brand over others.

Similar to the exercise I suggested for YouTube, collect product reviews from different platforms.

Ask any LLM tool to analyze these reviews and prepare a list of pain points.

Here are the review platforms you should check out based on your business type:

| Platform | Type of Business |

|---|---|

| Amazon | Consumer products |

| G2 | B2B software & services |

| Trustpilot | Services (consumer & B2B) |

| Capterra / Software Advice | B2B tools & software |

| Google My Business | Local & service businesses |

| Yelp | Local services & hospitality |

| TrustRadius / PeerSpot | Enterprise B2B |

| Industry-specific sites (Healthgrades, Avvo, etc.) | Niche industries (healthcare, legal, etc.) |

Make Audience Research Your Competitive Edge

Audience research isn’t simply a box to check.

The more you know about your buyers, the stronger results your marketing efforts can produce.

What’s even better, your audience is already leaving signals about what they want.

When you listen closely and capture these insights, you can create content and launch campaigns that hit closer to home.

Download our Audience Research Tracker to easily document this data and turn these insights into content opportunities.

Next up: Wondering how to tie all your audience-centric content ideas together? Check out our guide on building a customer-focused content strategy to put this research to work.

Backlinko is owned by Semrush. We’re still obsessed with bringing you world-class SEO insights, backed by hands-on experience. Unless otherwise noted, this content was written by either an employee or paid contractor of Semrush Inc.